Data-driven perspectives on the business of biotech

I write data-driven articles and analyses on biotech startups and venture capital. Content ranges from deep dives on industry trends to resources for learning about the industry.

I've worked in biotech startups my whole career, as an investor, at startups and as a financial analyst in investment banking and on the healthcare team of a FAANG company.

We also develop tools to automate biotech finance and investing workflows. We have a clinical trial cost estimator, a drug launch benchmarking tool, and many other internal tools related to collecting and analyzing clinical data and financial information.

Most popular posts

Other posts

The biotech venture capital crunch

Huge amounts of money have flowed to biotech startups over the last decade. But that trend may be reversing -- in a big way.

Diagnosing the problem with biotech R&D

Startup investors are good at predicting which drugs will win FDA approval. But it has proven more difficult to pick which drugs will make money and generate compelling returns on R&D investment.

The next generation of biotech VCs

After over a decade of dominating the biotech venture landscape, established biotech VCs like Atlas, Versant, Third Rock and 5AM Ventures are ceding share to upstart VCs. Will these VCs lead the industry into the next boom, or are they just the last to leave the COVID-bubble party?

Will a recession save biotech?

After a brutal year and a half, biotech is rebounding. But the cause of the turnaround is an unlikely one: an impending global economic recession.

Biotech platforms are out, products are back in

Buzzy biotech platforms, including tech-bio companies and SPACs, have been hurt most by the post-COVID crash.

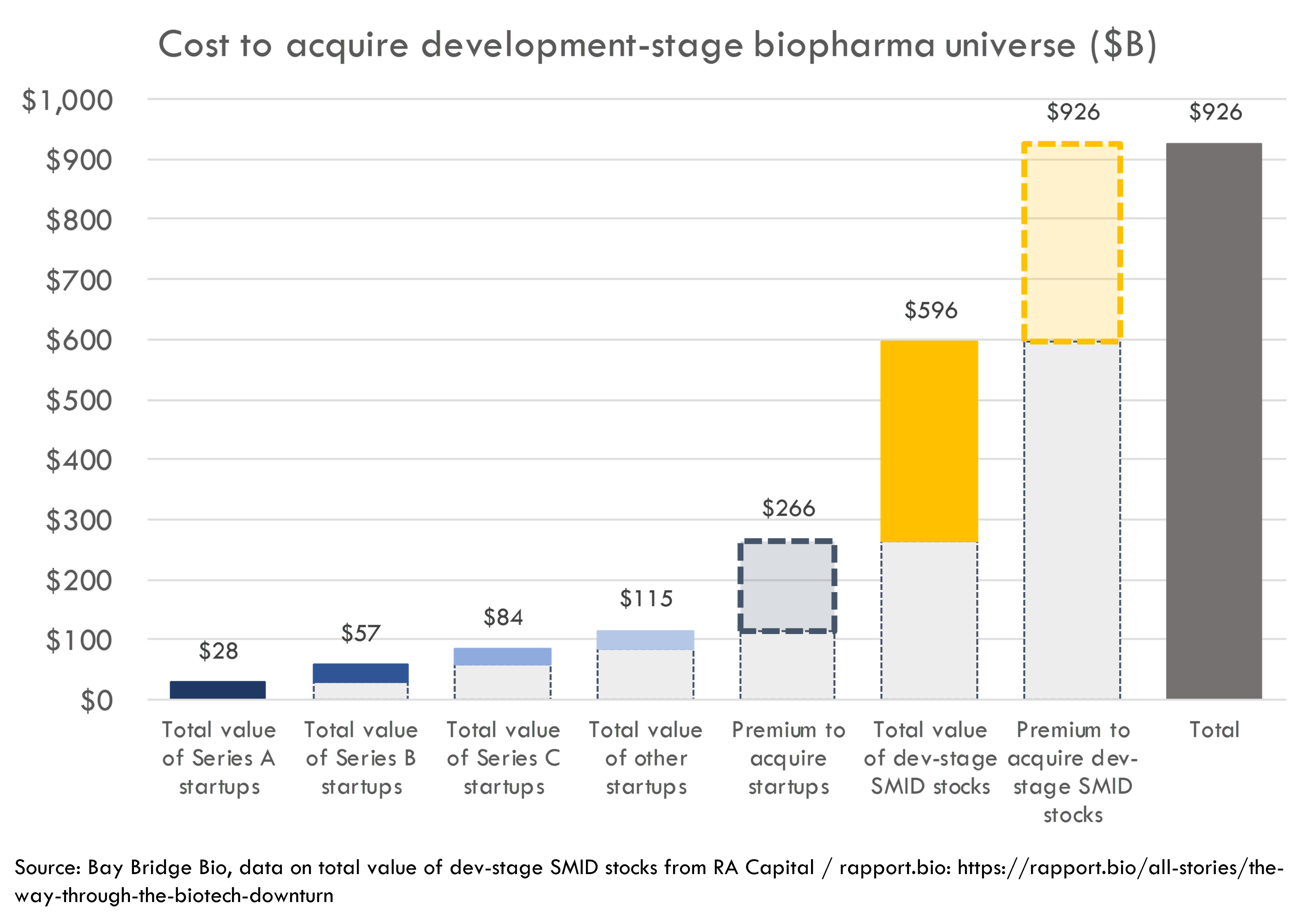

Can big pharma buy every biotech startup?

Big pharma is sitting on a record amount of cash. How much of the biotech startup universe can they afford to acquire?

Biotech crossover investors facing steep losses

The biotech crash has been hard on crossover investors. After more than doubling during COVID, how have the top crossover investors' portfolios fared during recent market turbulence?

Who's still investing in biotech stocks (Q1 2022)?

Amid crashing equity markets, which biotech investors are shedding risk, and who has gone bargain hunting?

Who's still investing in biotech startups (Q1 2022)?

Venture investment into biotech startups is down 60% from its peak in early 2021. Who is still investing?

Biotech's new normal

After a historic boom, biotech's recent losses are approaching dotcom-bust level -- and we may not have seen the worst yet. When the dust settles, what will the new normal look like?

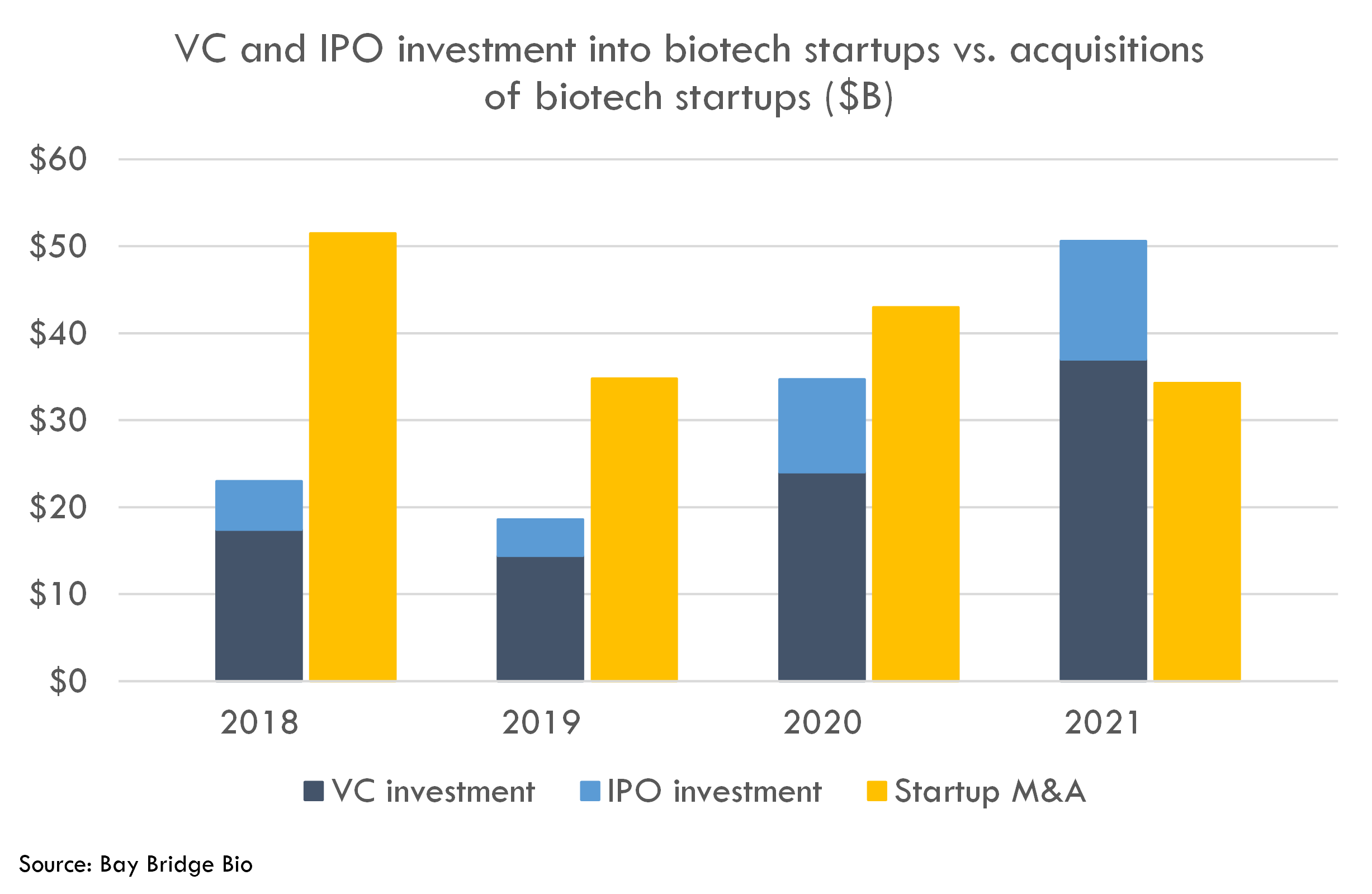

The biotech M&A gap

In 2021, more money was invested in biotech startups than was returned to investors from M&A. This has never happened before 2021. What does it mean for the startup ecosystem?

Who will save biotech?

The recent biotech crash is the fourth in the last 10 years. In each prior crash, the market quickly bounced back because the Fed came to the rescue. But this time may be different.

Biotech venture funding is declining

Monthly venture investment in biopharma startups is down 61% from March 2021 to March 2022, amid the biggest biotech crash since the dotcom bubble.

Big investors slashing exposure to early-stage biotech

In what could signal the end of a historic boom, the investors who funded the biggest IPO boom in biotech history are abandoning risky biotech stocks.

Biotech from bust to boom

The last ten years have seen the biggest boom in the history of biotech. But the future is uncertain.

The top biotech IPO investors

How have the top biotech IPO and crossover investors fared during the biotech crash?

The biotech IPO crunch

A slowing IPO market combined with the biggest-ever crop of IPO-seeking startups has created a big supply / demand imbalance in the IPO market.

Biotech in 2021: a tale of two halves

The first half of 2021 represented the peak of a historic boom. The second half was the beginning of a historic crash.

Biotech's bad November

Biotech stocks had a bad November, with the XBI down 10%. How did this impact venture funds?

How are biotech crossover VCs performing?

We analyzed the performance of biotech crossover VCs.

How are Series A biotech VCs performing?

Analysis of the performance of Series A biotech VCs: deal-level cash-on-cash returns, number of investments and exits, and percentage of investments that fail to raise the next round.

Biotech IPO returns are declining

Analysis of the performance of biotech IPOs from 2018-1H 2021. IPO returns are declining while private market valuations continue to rise.

Comparing VC returns in biotech vs. tech

Comparing return distributions of biotech venture investments vs. other venture sectors.

Expected returns of biotech VC investments

Analyzing expected returns for Series A-C investments in biotech startups.

Anatomy of a top venture fund

Analysis of the portfolios of three of the best-performing venture funds since 2007.

Anatomy of a "decacorn": tech vs. biotech

How do investments in the best-performing tech startups compare to the best-performing biotech startups?

Are startups 5x better at R&D than big pharma?

It is commonly accepted that startups are more innovative than big companies. Is this true in the biopharma industry?

Intro to clinical data: a case study of aducanumab

Aducanumab may be the biggest drug of all time. But Biogen is seeking FDA approval based on a post-hoc analysis. Are they data dredging, or is this the first disease modifying drug for Alzheimer's?

How an unemployed 29 year old and team of young scientists created the biotech industry

Lessons on building a lasting biotech company from the founders of Genentech.

A synthetic biology paper in layman's terms

A synthetic biology paper from Michael Lin's lab at Stanford, in layman's terms. Introduces basic engineering techniques and cancer biology concepts.

VC and finance

Valuing drug programs and biopharma companies

An interactive tool for valuing drug programs and explaining basic concepts in biopharma valuation.

The world's most expensive drug?

An introduction to biotech business and finance through the analysis of the company that developed what will likely be world's most expensive drug. Includes downloadable financial model.

Biotech finance 101: P&L forecasting

First post in a series about biotech finance, aimed at finance professionals who are interested in biotech, focused on fundamentals of P&L forecasting for drug companies.

Biotech finance 102: Valuation techniques and modeling considerations

Second post in a series about biotech finance, aimed at finance professionals who are interested in biotech, focused on common valuation techniques for biopharma companies.

Valuations of biotech startups from Series A to IPO

Analysis of biopharma IPOs from 2018-Q12019: therapeutic area, therapeutic modality, development stage, and valuation of venture rounds.

Venture returns from biopharma IPOs, 2018-Q1 2019

Analysis of returns of venture investments in biopharma companies that went public from 2018-Q12019.

Top biotech venture funds of 2018

A look at the top biopharma venture capital funds of 2018.

Biopharma VC Basics 1: What do VCs do?

Describes the role of biopharma venture capital in the biotech system and economy as a whole.

Biopharma VC Basics 2: How do VCs work?

Overview of who venture capital firms serve, what their responsibilites are, and how they make money.

2019 IPO market outpacing 2018, but VC funding down 25%+

A quick update on the VC and IPO markets: the IPO market stays strong, but venture funding is down from 2018's record levels.

Biopharma VC recovers from December lows

Biopharma VC funding in January 2019 recovers from its December 2018 lows, though Series A funding continues its year-long trend downward.

The case for young biotech CEOs

A summary version of the posts is here.

Part 1: Inexperienced CEOs have built as many lasting biotech companies as experienced CEOs

Part 2: Why don't investors fund young biotech CEOs?

Part 3: A new kind of biotech startup needs a new kind of founder

The biopharma opportunity

Why now is the best time ever to start biopharma company

Exploration of business, scientific and technological trends driving the explosion in biotech innovation and funding in the last five years.

A few charts on the Bio opportunity, and some problems startups can address (part 1/2)

A few charts describing the opportunity in bio and some of the problems facing the industry.

A few charts on the Bio opportunity, and some problems startups can address (part 2/2)

Some examples of problems in biopharma that startups might be suited to solving.

Startups

What are the characteristics of the top biotech startups?

A few characteristics that many successful biotech startups have.

Pitch basics: unmet need

First short post in a series describing common topics to cover in a pitch, focused on unmet need and clinical development.

Pitch basics: products and pipeline

Second short post in a series describing common topics to cover in a pitch, focused on products and pipeline.

Pitch basics: technology and platform

Third short post in a series describing common topics to cover in a pitch, focused on technology and platform.

Pitch basics: development plan

Fourth short post in a series describing common topics to cover in a pitch, focused on development plans.

Industry and trends

Drug development basics

Overview of the stages and costs of the drug development process, intended for those not too familiar with the industry.

2018 biopharma VC funding passes $3B; China on the rise

Update on YTD 2018 venture funding trends in biopharma, notably the rise of Chinese investment.

The biopharma startup job search

Overview of the current biopharma startup environment and ideas for how to navigate the job search.