Agomab Therapeutics investment analysis

October 17, 2023

This is not investment advice. We used AI and automated software tools for most of this research. We did some fact checking but cannot guarantee the accuracy of everything in the article. We do not have a position in Agomab or a relationship with the company.

Overview

Agomab Therapeutics develops tissue-specific treatments to potentially reverse fibrosis in fibrotic diseases.

Fibrotic diseases can lead to severe organ failure. Current treatments typically manage inflammation without halting disease progression. Agomab is targeting growth factor pathways, specifically TGFβ and HGF/MET, to potentially halt or reverse fibrosis.

The TGFβ pathway, central to fibrosis, is challenging to target due to its role in healthy cellular functions. To navigate this, Agomab uses organ-specific ALK5 inhibitors, minimizing systemic effects.

Their lead program, AGMB-129, is a GI-tract-specific ALK5 inhibitor in Phase 2a trials for Fibrostenosing Crohn’s Disease (FSCD) and has received Fast Track Designation. Additionally, Agomab is working on a lung-specific ALK5 inhibitor for pulmonary fibrosis and two cMET receptor agonists for fibrotic disorders.

Agomab Therapeutics Pipeline Overview

| Product name | Modality | Target | Indication | Discovery | Preclinical | Phase 1 | Phase 2 | Phase 3 | FDA submission | Commercial | Description |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AGMB-129 | Small molecule | ALK-5 inhibitor | Fibrostenosing Crohn's disease | GI-restricted oral small molecule ALK-5 inhibitor | |||||||

| AGMB-447 | Small molecule | ALK-5 inhibitor | Idiopathic pulmonary fibrosis | Lung-restricted inhaled small molecule ALK-5 inhibitor | |||||||

| AGMB-101 | Monoclonal antibody | MET agonist | Fibrotic indications | Full MET agonistic mAb | |||||||

| AGMB-102 | Monoclonal antibody | MET agonist | Fibrotic indications | Partial MET agonistic mAb |

The company has raised over $200M (most recently a $100M Series C led by Fidelity in Oct 2023) from leading investors including Fidelity, EQT, Canaan, KKR / Dawn Biopharma, Pfizer, Redmile, Pontifax, Boehringer Ingelheim and others. The company raised a $74M Series B in March 2021 (near the peak of the COVID bubble) led by Redmile and Cormorant -- a typical COVID-era crossover round likely valued at a post-money of $200-400M. Seven months later, the company acquired Origo Biopharma. Agomab's lead asset, AGMB-129, was acquired as part of that acquisition, and this shift in strategy attracted Pfizer to lead a Series B extension in mid-2022.

Highlights and risks

Targeting well validated pathways (TGF-beta, HGF/MET) implicated in many diseases

Potential to overcome challenges of targeting TGF-beta by limiting systemic exposure (and sparing healthy tissue)

Lead asset in Phase 2, with Phase 1 data providing evidence supporting therapeutic hypothesis (limited systemic exposure)

Potential for differentiated assets (they are trying to slow / reverse fibrosis rather than address symptoms)

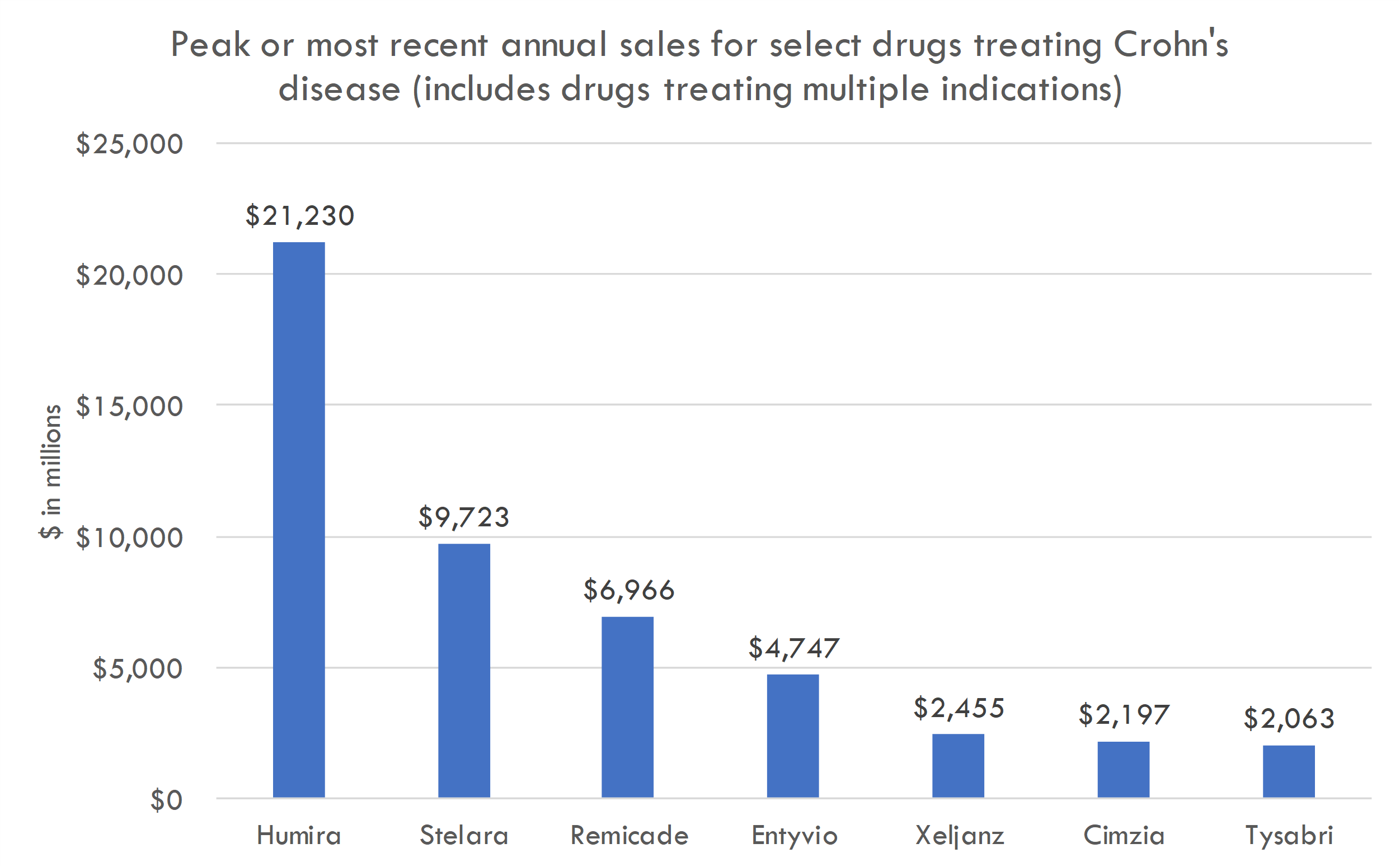

Targeting large markets (recently approved drugs in Crohn's and IPF generated billions in revenue)

Clear unmet need in lead indication FSCD, which impacts 50% of Crohn's patients and is a major driver of surgery

No direct clinical evidence that their programs slow / reverse fibrosis

TGFβ is a complex pathway and the impact of TGFβ targeting on FSCD fibrosis is unclear

Targeting TGFβ has known safety risk from studies of other agents. Phase 1 data shows limited systemic exposure in healthy vols but larger, longer-term studies in patients may reveal safety issues

The company is entering human POC studies, a high-risk phase in drug development with therapeutic-area-wide likelihood of approval rates below 50%. Despite promising Phase 1 results, significant efficacy and safety concerns remain.

Macro / funding risk: we estimate the post-money of this round to be around $300-400M. Our analysis suggests this valuation prices in a high likelihood of either near-term IPO or peak sales of over $4-5B; if IPO market remeains closed, valuation could create overhang.

Valuation

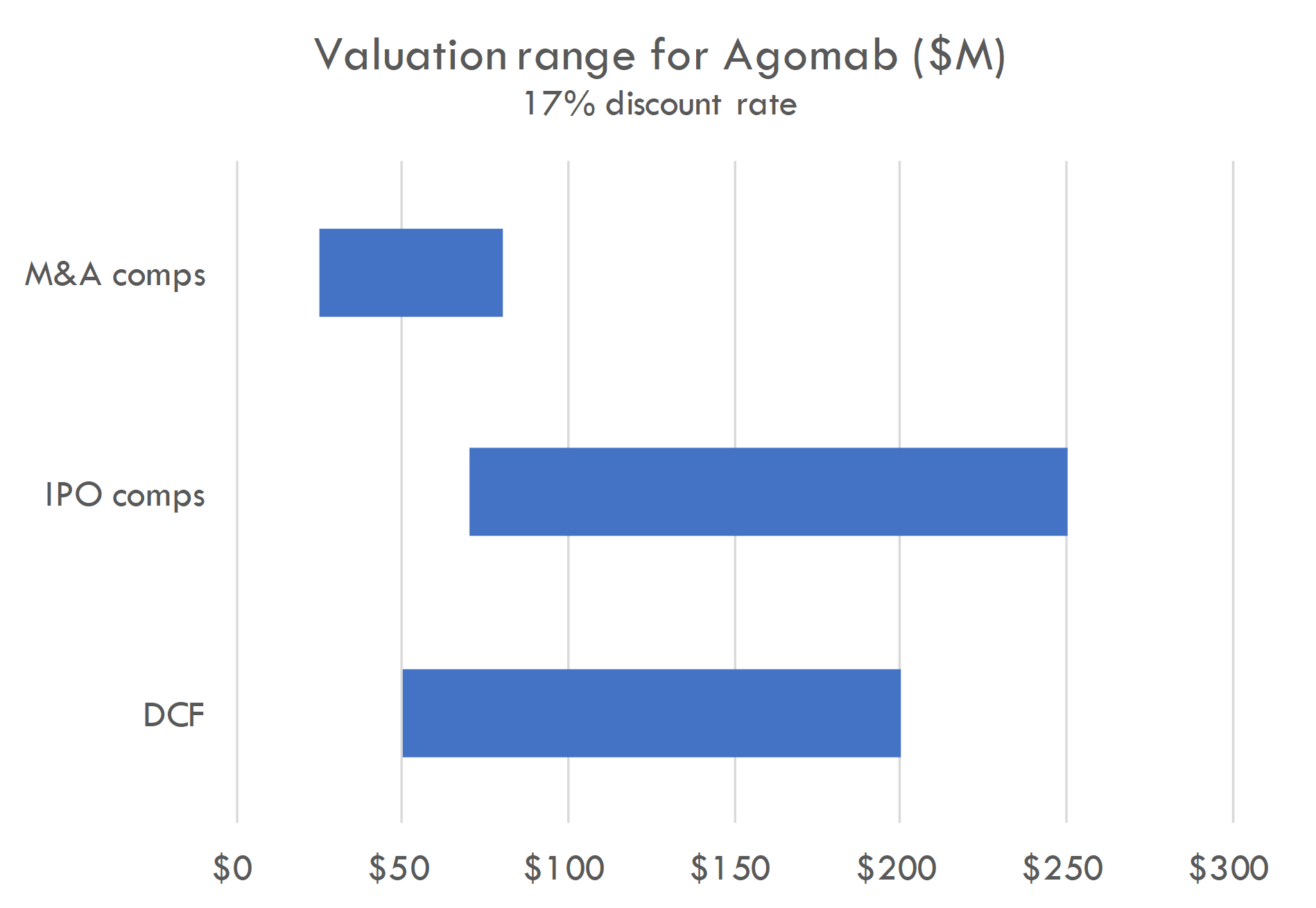

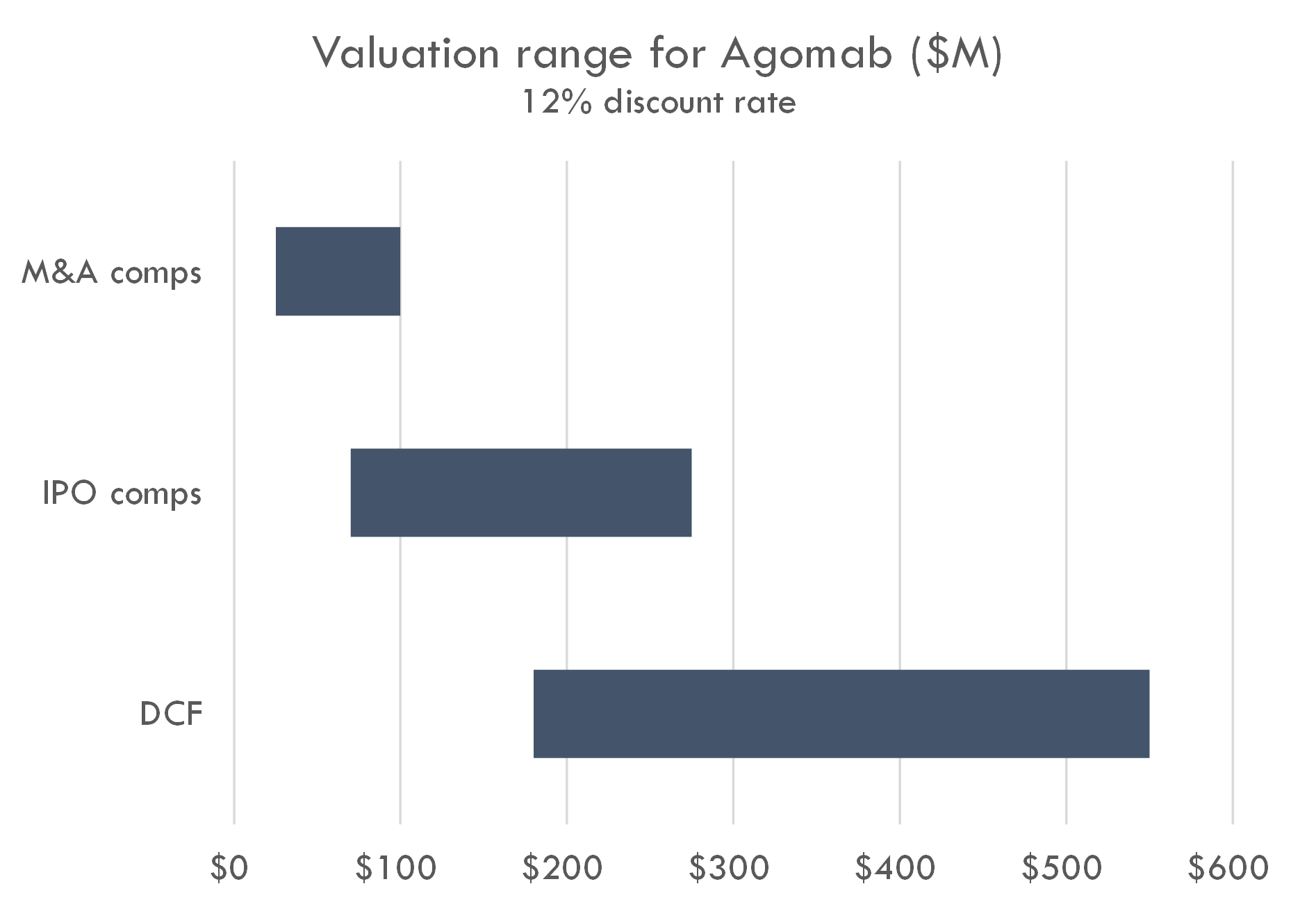

Based on the size of the latest round ($100M Series C in Oct 2023) and the fact that Series C deals often take 15-30% of total equity, we estimate the round was priced in the $300-400M range. The company raised a $74M Series B crossover round in March 2021, near the height of the COVID bubble, and rounds in that period were generally priced in the $200-400M post-money range. Thus a $100M Series C at a $300-400M post-money could have been done at a flat price / slight step-up to the Series B.

Our analysis supports a $300-400M post-money valuation assuming a 12% discount rate. At a 17% discount rate, a $300-400M valuation prices in either 1) a high likelihood of a near-term IPO with a post-money around $1B, 2) peak sales across all assets of $5B+, or 3) higher-than-average probability of approval and $2.5B+ in peak sales. This valuation could also be supported by potential M&A assuming a probability of Phase 2 success that is higher than industry-standard and a high likelihood of $1B+ M&A after Phase 2.

The company is a near-term IPO candidate given 1) the syndicate of crossovers (including Fidelity leading the recent Series C), 2) lead program in mid-stage studies, 3) potential first-in-class / best-in-class products with pipeline-in-product potential.

One remaining bright spot in the biotech market is that big pharma still pays big money for derisked potential blockbuster assets. Agomab checks the boxes as a potential future M&A candidate. Public assets with M&A potential are already valued highly, so investing in the IPO could be viewed as a way to invest ahead of M&A speculation, which could occur if human POC data are positive. Of course, investing ahead of this data bears the risk that Phase 2 or 3 trials fail.

Of course, we could be wrong about our estimate of the company's most recent round, in which case the above is not relevant. It is also important to note that this valuation analysis is a very rough estimate based on very limited information about the company, and was performed with automated tools, so this should not be relied on for making investment decisions.

Pipeline analysis

Scientific thesis

Fibrotic diseases can lead to severe organ failure, and current treatments primarily manage inflammation without halting or reversing the disease's progression. Agomab aims to repair tissue damage and restore organ function by targeting growth factor pathways, which influence the complex processes of fibrosis more broadly than inflammation-focused treatments.

The challenge with targeting these broad processes is that they are also involved in crucial healthy cellular function, potentially reducing or eliminating the therapeutic window.

TGFβ is central to fibrosis, driving the transformation of fibroblasts to myofibroblasts and promoting pro-fibrotic genes. Agomab has developed organ-specific ALK5 inhibitors to block the TGFβ pathway without widespread systemic effects, circumventing the issues found with traditional TGFβ inhibitors.

The HGF/MET pathway plays roles in cell growth and differentiation, and its receptor, MET, is found in many cell types, including those linked to fibrosis. While HGF has therapeutic potential, its direct clinical use has been hindered by its short plasma lifespan and production challenges. To overcome this, Agomab leverages argenx’s SIMPLE antibodyTM technology to produce MET-agonistic antibodies, targeting the HGF/MET pathway effectively.

AGMB-129 Program for Fibrostenosing Crohn’s Disease (FSCD)

Fibrostenosing Crohn’s Disease (FSCD) is characterized by fibrotic strictures that develop in nearly half of the patients with Crohn's disease. These strictures pose a significant therapeutic challenge as they are the primary reason for bowel surgery in approximately 75% of Crohn’s disease patients.

As mentioned above, TGFβ is a central driver of fibrosis in many diseases, including in the GI tract. AGMB-129 is designed to specifically target the GI tract, potentially improving fibrosis at the site of disease without impacting other organ systems. Phase 1 data suggests that the drug is working as intended, with limited systemic exposure observed.

AGMB-129 and -447 were acquired via Agomab's October 2021 purchase of Origo Biopharma.

- Mechanism: AGMB-129 is an oral, GI-restricted small molecule that inhibits ALK-5 (or TGFβR1). Its design to target ALK5 in the GI tract, combined with its rapid first-pass metabolism in the liver, ensures minimal systemic exposure. This is a key advantage, as it reduces potential side effects associated with systemic TGFβ inhibition.

- Unmet need: Despite the high prevalence of fibrostenotic complications in Crohn's disease patients, there aren't any approved specific treatments for FSCD. AGMB-129, by targeting a well-established fibrosis pathway in a localized manner, offers a potentially safer and more effective therapeutic option.

- Clinical development:

- Phase 1 study:

- Design: This trial assessed the safety, tolerability, and pharmacokinetics (PK) of AGMB-129 in healthy participants, involved various stages: single ascending dose (SAD), multiple ascending dose (MAD), food-effect (FE), and an additional stage to evaluate local drug exposure in the ileal mucosa.

- Participants: 81 healthy subjects were part of this trial, randomized to either single/multiple daily oral doses of AGMB-129 or a matching placebo.

- Outcomes: The drug demonstrated high local exposure in the ileum without significant systemic exposure. It was well-tolerated across all doses with no identified drug-related safety concerns or dose-limiting toxicities.

- STENOVA Phase 2a Clinical Trial

- Design: This is a global study involving 36 patients with symptomatic FSCD, spanning multiple centers across the USA, Canada, and Europe.

- Endpoints: The primary goals are to evaluate the safety and tolerability of AGMB-129 in FSCD patients. Secondary goals include analyzing the drug's pharmacokinetics and target engagement.

- Catalyst date: Clinicaltrials.gov lists December 2024 as the completion date for the study.

- FDA Fast Track Designation: AGMB-129 is the inaugural drug candidate to be awarded the FDA Fast Track Designation for treating FSCD. This designation accelerates the development and review of therapies for severe or life-threatening conditions where there's a notable medical need gap.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.

AGMB-129 risks

- Efficacy Concerns:

- The Phase 1 study primarily focused on safety, tolerability, and pharmacokinetics in healthy subjects. While this data is promising, it doesn't guarantee the drug's efficacy in actual patients with Fibrostenosing Crohn’s Disease (FSCD).

- Targeting the TGFβ pathway is theoretically promising, but the pathway is complex and has multifunctional roles in the body. There is a risk that inhibiting ALK5 might not be as effective in reducing fibrosis or improving clinical outcomes as hoped.

- Safety in Long-Term Use:

- While AGMB-129 was well-tolerated in the short duration of the Phase 1 study, longer-term administration in patients (as might be required for a chronic condition like FSCD) could reveal safety concerns not observed in short-term trials.

- The focus on GI-restricted delivery is designed to minimize systemic side effects. However, even localized alterations to the TGFβ pathway could have unforeseen consequences in the gastrointestinal system, given its critical roles in tissue repair, immunity, and other cellular functions.

- Population Differences:

- The Phase 1 study was conducted in healthy subjects, while the Phase 2a will be in FSCD patients. There's a risk that AGMB-129 may behave differently in the patient population, especially in terms of absorption, distribution, metabolism, and excretion.

- Variability across different ethnicities or demographics can also influence drug response, and it remains to be seen how representative the Phase 2a trial population will be of the broader FSCD patient population.

- Study Design Risks:

- The randomized, double-blind, placebo-controlled design of the Phase 2a trial is the gold standard for clinical studies. However, there's always a risk of bias, especially if there are challenges in maintaining the double-blind nature of the trial.

- The study's duration might not be long enough to capture certain outcomes or adverse events.

- The relatively small sample size of 36 patients may not be large enough to detect rare but significant adverse events or to provide strong evidence of efficacy.

- Regulatory Risks:

- Even if the drug shows promise in the Phase 2a trial, it will still need to progress through further phases of clinical development and meet FDA requirements for safety and efficacy. A Fast Track Designation, while beneficial for expediting the process, doesn't guarantee eventual approval.

- Unexpected findings in non-clinical (e.g., animal) studies could also impact the drug's development trajectory.

- Commercial and Market Risks:

- If approved, the drug will have to find its place in the therapeutic landscape, where surgery is currently a primary intervention for strictures. Market adoption may be influenced by factors like cost, patient and physician perceptions, and the presence or development of competing treatments.

- Unforeseen Side Effects:

- The pharmacological targeting of complex pathways, like TGFβ, might introduce unforeseen side effects due to the pathway's extensive involvement in various biological processes.

AGMB-129 market opportunity

Fibrostenosing Crohn’s Disease is a subtype of Crohn's disease characterized by the development of fibrotic strictures, or narrowing, in the intestines. These strictures result from an excessive deposition of extracellular matrix proteins in the intestinal wall, leading to scar tissue formation. The process is believed to be a result of chronic inflammation and a failed wound-healing response.

Patients with fibrostenosing Crohn’s Disease often present with symptoms of bowel obstruction, including abdominal pain, bloating, nausea, and vomiting. Over time, these strictures can lead to partial or complete blockages in the intestine, necessitating medical intervention.

- Current Standard of Care

- Medical Management: Anti-inflammatory medications like corticosteroids, immunosuppressants (e.g., azathioprine, methotrexate), and biologic therapies (e.g., anti-TNF agents like infliximab and adalimumab) are commonly prescribed to reduce inflammation and potentially slow down the progression of fibrotic changes. However, they are not specifically effective against established fibrosis.

- Endoscopic Dilation: This procedure involves the use of an endoscope to stretch open the narrowed segment of the intestine. It's a less invasive alternative to surgery and can provide temporary relief for some patients.

- Surgery: When strictures lead to bowel obstructions or become symptomatic and unmanageable with medical therapy or endoscopic dilation, surgical intervention might be required. Surgery often involves removing the affected section of the intestine. While effective in treating the strictures, surgery isn't a cure for Crohn's disease, and inflammation or fibrosis can recur in another part of the intestine.

- Unmet need

- Specific Anti-fibrotic Therapies: Currently, there is no FDA-approved medication specifically designed to treat or reverse the fibrosis associated with FSCD. While the available therapies can manage inflammation, they do not directly target the fibrotic process.

- Recurrence After Surgery: Even after surgical intervention, many patients experience recurrence of disease activity, leading to the development of new strictures.

- Disease Progression: Fibrotic strictures can develop in nearly 50% of patients with Crohn's disease, and they remain a significant therapeutic challenge. The strictures are the primary reason for bowel surgeries, which occur in approximately 75% of Crohn's disease patients over their lifetime.

- Morbidity and Quality of Life: The symptoms associated with strictures, such as pain and bowel obstruction, significantly impact the quality of life. Additionally, repeated surgeries and hospitalizations add to the morbidity of the disease.

- Market sizing

- US revenue build

- Total Patient Population: Crohn's disease is believed to affect up to 780,000 Americans. Considering that fibrotic strictures develop in nearly 50% of these patients, we're looking at around 390,000 potential FSCD patients in the U.S.

- Addressable Market: Not every patient will be diagnosed, treated, or meet the criteria for AGMB-129. If we assume that 20% of the FSCD patients are in the addressable market, that equates to 78,000 patients.

- Market Penetration: As a pioneering treatment, uptake may start slow but can amplify as awareness and accessibility rise. If AGMB-129 captures 10% of the addressable market initially, that's 7,800 patients treated annually in the U.S.

- Pricing Strategy:: The U.S. often has higher drug prices compared to other countries. Using the benchmark of biologics like Infliximab and Adalimumab, which can cost $20,000 to $30,000 or more annually, and considering AGMB-129's novel oral administration and potential safety profile, it might be priced at around $30,000 annually. Thus, potential revenue from the 7,800 patients would be $234 million.

- Attrition

- Non-adherence: 30% (This implies that 70% of patients adhere to the treatment, but 30% do not.)

- Non-adherence to medication is a widespread issue across many chronic conditions. According to a review in the Annals of Internal Medicine, non-adherence can be up to 50% in developed countries across various conditions. For Crohn's disease and other inflammatory bowel diseases (IBD), studies have shown non-adherence rates ranging from 7% to 72%, with a median non-adherence rate of about 30-40%.

- Osterberg L, Blaschke T. "Adherence to medication." N Engl J Med. 2005;353(5):487-497.Jackson CA, Clatworthy J, Robinson A, Horne R. "Factors associated with non-adherence to oral medication for inflammatory bowel disease: a systematic review." Am J Gastroenterol. 2010;105(3):525-539.

- Efficacy & Improvement: 10% (This is the fraction of patients who might discontinue due to feeling better.)

- Some patients might experience significant improvement or remission and decide, either on their own or in consultation with their healthcare provider, to stop taking the medication. This assumption can be more prevalent in conditions where symptoms can be sporadic. In the context of IBD, remission rates can vary depending on the severity and treatment, but a ballpark figure of 10% was taken as a conservative estimate.

- Peyrin-Biroulet L, Sandborn W, Sands BE, et al. "Selective review of Janus kinase inhibitors in gastrointestinal diseases." Gut. 2020;69(4):790-800.

- Drug not working: 20% (This is the fraction of patients who might discontinue because the drug isn't effective for them.)

- Not all patients will respond favorably to a specific medication. Treatment-resistant or refractory cases are relatively common in many diseases. In Crohn's disease, primary non-response (no initial improvement) or secondary loss of response (loss of efficacy over time) can occur. Estimates suggest that up to 20-30% of patients might not respond initially to some of the current treatments.

- Gisbert JP, Marín AC, McNicholl AG, Chaparro M. "Systematic review: factors associated with relapse of inflammatory bowel disease after discontinuation of anti-TNF therapy." Aliment Pharmacol Ther. 2015;42(4):391-405.

- Other Factors: 10% (This accounts for side effects, cost, access issues, etc.)

- This is a catch-all category to account for various factors such as side effects, access issues, cost, physician's preference for other treatments, or patient preference. This figure is a rough estimate, taking into account general drug discontinuation rates due to adverse effects or other non-efficacy related reasons across chronic conditions.

- DiMatteo MR, Giordani PJ, Lepper HS, Croghan TW. "Patient adherence and medical treatment outcomes: a meta-analysis." Med Care. 2002;40(9):794-811.

AGMB-447 for Idiopathic Pulmonary Fibrosis (IPF)

Agomab's AGMB-447 is an inhaled, lung-specific ALK5 inhibitor (targeting TGFβR1) designed to potentially reverse fibrosis in Idiopathic Pulmonary Fibrosis (IPF), a serious lung condition.

IPF is a severe lung disorder that impacts over 300,000 patients globally. The disease is marked by uncontrolled accumulation of fibrotic or scar-like tissue within the lungs' structural framework.

Due to this fibrosis, the lung tissue becomes rigid, leading to breathing difficulties and decreased oxygen absorption from inhaled air into the bloodstream.

The average life expectancy after IPF diagnosis, without a lung transplant, is a mere 3-5 years, emphasizing the gravity and unmet need in treating this condition.

Transforming Growth Factor-beta (TGFβ) plays a central role in the progression of IPF as it is a primary regulator of fibrosis. Preliminary clinical data underpin its significance in IPF's underlying mechanisms.

This drug is engineered to inhibit ALK5 in the respiratory tract without systemic exposure by undergoing rapid hydrolyzation in the bloodstream.

Therapeutic rationale

The role of Transforming Growth Factor-beta (TGFβ) in the pathogenesis of Idiopathic Pulmonary Fibrosis (IPF) is well-established in the scientific literature.

- Supportive evidence

- Key Role in Fibrogenesis: TGFβ has been identified as a primary cytokine involved in the fibrotic process. It stimulates fibroblast proliferation, differentiation into myofibroblasts, and extracellular matrix production – all pivotal processes in the development of fibrotic tissue.

- Increased Expression in IPF: Studies have shown increased expression levels of TGFβ in the lungs of patients with IPF, especially in fibroblastic foci, which are believed to be active sites of fibrogenesis.

- Animal Models: Animal models of lung fibrosis have demonstrated that overexpression of TGFβ in the lungs leads to a rapid and pronounced fibrotic response, further underscoring its role in fibrogenesis.

- Risks

- Safety Profile: The respiratory tract is sensitive, and any drug developed for inhalation needs to ensure that it doesn't cause airway irritation, bronchospasm, or other pulmonary adverse events.

- Target Specificity: While TGFβ plays a key role in fibrosis, it also has various other functions in immunity, inflammation, and cellular processes. Inhibiting TGFβ might have unintended consequences or off-target effects.

- Drug Delivery: Ensuring consistent and effective drug delivery deep into the lungs can be challenging. The efficiency of drug delivery could be affected by factors like patient compliance, device used, and patient's lung function.

- Long-term effects: Since IPF is a chronic disease, treatments might be used for extended periods. The long-term safety and efficacy of AGMB-447, especially in terms of halting or reversing fibrosis, remain to be seen.

- Competition: There are already some approved treatments for IPF. While these treatments don't cure the disease, they have shown to slow its progression. AGMB-447 would need to demonstrate superior efficacy, safety, or both, to gain significant market share.

- Systemic Exposure Concerns: Even though AGMB-447 is designed to avoid systemic exposure, there's always a risk that some drug might enter the systemic circulation, leading to potential off-target effects or adverse events.

Market opportunity

- Patient population: The program mentions that over 300,000 patients are affected by IPF worldwide. However, for the sake of this analysis, let's focus on the US opportunity. It's estimated that the prevalence of IPF in the US is between 14-43 per 100,000 people. Given a US population of approximately 330 million, this translates to between 46,200 to 141,900 patients in the US.

- Treatment landscape: There are currently two FDA-approved drugs for IPF: nintedanib (Ofev) and pirfenidone (Esbriet). Esbriet generated a global revenue of about $1.13 billion in 2019. Ofev generated around $1.7 billion in global sales in 2019.

- Pricing and adoption: The actual pricing of AGMB-447 is unknown, but for reference, Ofev's and Esbriet's annual costs are in the range of $90,000 to $100,000 per patient. Given the innovative delivery method and potential differentiation of AGMB-447, we can estimate a similar or slightly premium price. Let’s assume that if AGMB-447 demonstrates superior efficacy and safety, it could capture 20% of the market in the initial 2-3 years post-launch.

- Revenue estimate: Assuming the average price per patient per year for AGMB-447 is $95,000 and a 20% market capture:

- Low Estimate: 46,200 patients x 20% adoption x $95,000 = $876.6 million/year

- High Estimate: 141,900 patients x 20% adoption x $95,000 = $2.69 billion/year

AGMB-101 and -102

AGMB-101 and AGMB-102 are Hepatocyte Growth Factor (HGF)-mimetic antibodies intended for treatment of fibrotic disease. Their primary mechanism of action is the agonism of the MET receptor, a key player in many cell processes.

The HGF/MET pathway is essential in regulating several cellular activities, including cell proliferation, survival, motility, differentiation, and regeneration.

Preclinical research has underscored the beneficial effects of the HGF/MET pathway in various inflammatory and fibrotic diseases. Given these promising outcomes, there's a strong rationale for developing therapeutics like AGMB-101 and AGMB-102 that can mimic the HGF function.

Agomab has leveraged the SIMPLE Antibody™ platform from argenx in developing these antibodies. This platform aids in the efficient identification and optimization of novel antibody therapeutics.

AGMB-101 is a full cMET receptor agonist, meaning it can fully activate the MET receptor, while AGMB-102 is a partial cMET agonist, indicating that it can activate the MET receptor but not to its full capacity.

AGMB-101 is currently undergoing IND-enabling studies, while AGMB-102 is still in discovery.

Given the tissue-agnostic nature of HGF’s regenerative capacity (meaning its effects aren't limited to a specific type of tissue), both AGMB-101 and AGMB-102 offer flexibility in terms of potential applications. They could be positioned for treatment in various inflammatory and fibrotic conditions.

Funding history

- Series A Financing (2019)

- Amount: AgomAb initially secured €21 million in a Series A financing round in April 2019. Later in October 2019, an extension to the Series A financing was announced with additional funding from a new investor, Andera Partners. This brought the total Series A funding higher than the initial €21 million, though the exact extended amount was not specified.

- Investors: The round was co-led by V-Bio Ventures (Belgium) and Advent France Biotechnology (France). It also saw participation from Boehringer Ingelheim Venture Fund (Germany), Omnes (France), and Pontifax (Israel).

- Pipeline at funding: AgomAb was developing growth factor-mimetic agonistic monoclonal antibodies with the potential for tissue regeneration. Preclinical packages highlighted potential applications across fibrotic, inflammatory, autoimmune, and degenerative diseases.

- Series B Financing (2021)

- Amount: Initially, AgomAb raised $74 million in a Series B financing round in March 2021. This amount was later augmented by an additional $40.5 million in July 2022, bringing the total Series B funding to $114 million.

- Key investors: The initial round was led by Redmile Group, with participation from Cormorant Asset Management and prior investors. The extension saw Pfizer lead the round through its Pfizer Breakthrough Growth Initiative. Other investors in the extension included Walleye Capital, Asabys Partners, and existing backers.

- Pipeline at funding: At this stage, AgomAb was actively advancing AGMB-129, a gastrointestinal tract restricted ALK-5 inhibitor for fibrostenotic Crohn's disease, which was in Phase 1 clinical trials. Other candidates, AGMB-447 (lung-restricted ALK-5 inhibitor for idiopathic pulmonary fibrosis) and AGMB-101 (MET receptor full agonist for organ failure), were in IND-enabling studies.

- Series C Financing (2023)

- Amount: AgomAb raised $100 million in a Series C financing round in October 2023.

- Key investors: The round was led by Fidelity Management & Research Company. New investors included EQT Life Sciences, Canaan, Dawn Biopharma (controlled by KKR), and prior investors.

- Pipeline at funding: Proceeds from this round aimed to support the STENOVA Phase 2a clinical trial evaluating AGMB-129 for Fibrostenosing Crohn’s Disease. The company also planned to progress AGMB-447 for idiopathic pulmonary fibrosis and introduce AGMB-101 and AGMB-102 for inflammatory and fibrotic indications.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.