Aiolos Bio investment analysis

October 24, 2023

This is not investment advice. We used AI and automated software tools for most of this research. A human formatted the charts based on data / analysis from the software, prompted the AI to do some editing, and did some light manual editing. We did some fact checking but cannot guarantee the accuracy of everything in the article. We do not have a position in Aiolos or a relationship with the company.

Overview

Aiolos Bio is a clinical-stage biopharmaceutical company headquartered in San Francisco and London. Their lead (and currently only) product is AIO-001, an anti-TSLP monoclonal antibody entering Phase 2 for moderate-to-severe asthma.

AIO-001 is a potential best-in-class TSLP antibody due to its potential 6-month dosing regimen. Tezspire, another TSLP antibody for asthma developed by Amgen and AstraZeneca, was approved in December 2021 and is projected to generate over $1B in annual revenue. Teszpire generated $133M in revenue in the second quarter of 2023, representing 37% quarter-over-quarter sales growth.

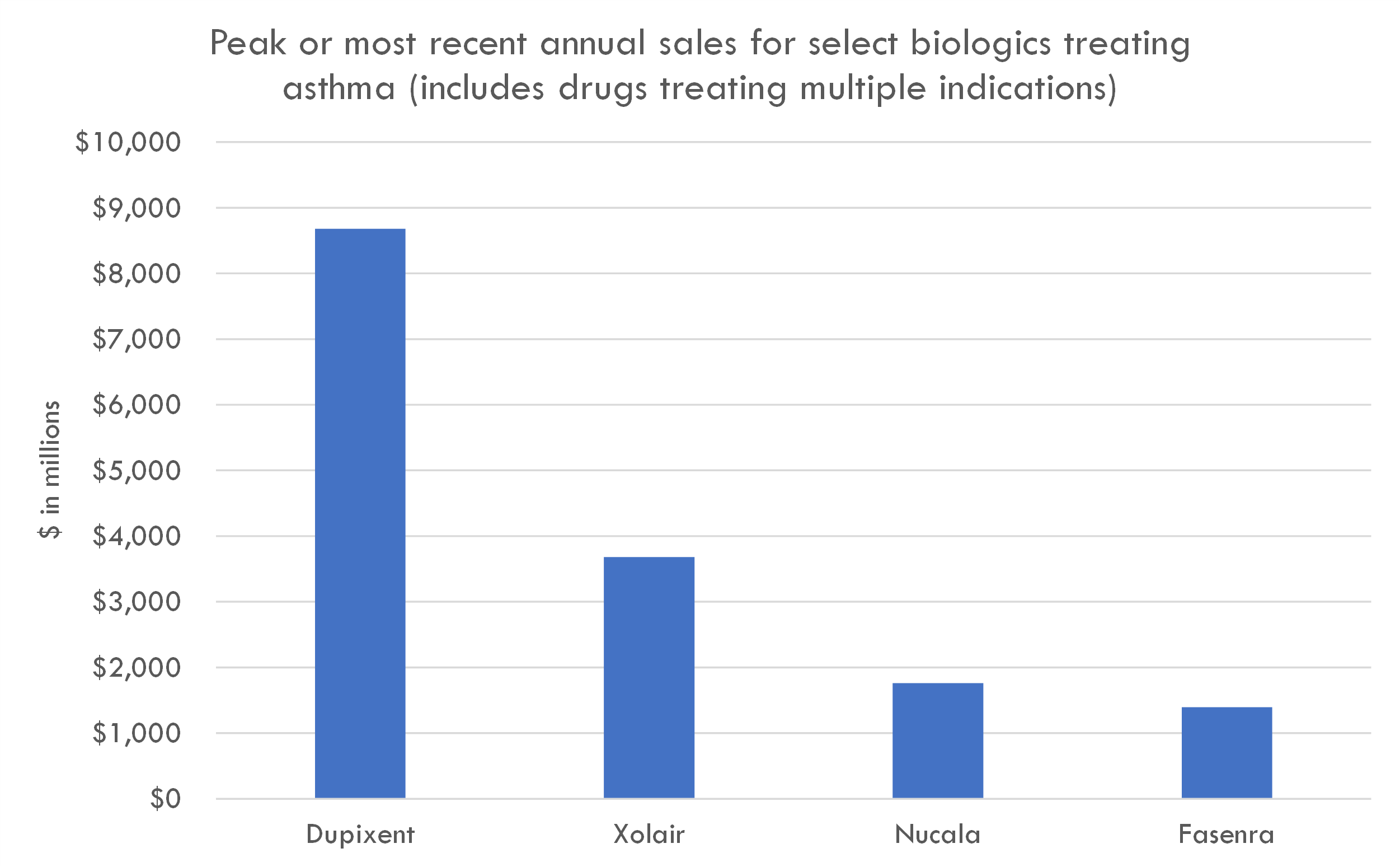

TSLP is a cytokine responsible for inducing inflammation. TSLP antibodies are a promising treatment for a broad spectrum of severe asthma patients. This segment represents approximately 10% of the global asthma population, equating to around 33.9 million patients. A distinct advantage of Tezspire over competitors like Dupixent (which generated $8.7B in annual revenue across all indications) is its applicability across a wider patient demographic; Dupixent's efficacy is restricted among those with low eosinophil levels, while Tezspire has demonstrated benefits even for this subgroup.

The company raised a $245M Series A in October 2023 from Atlas, Bain, Forbion, Sofinnova, and RA Capital Management.

Aiolos Bio Pipeline Overview

| Product name | Modality | Target | Indication | Discovery | Preclinical | Phase 1 | Phase 2 | Phase 3 | FDA submission | Commercial | Description |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AIO-001 | Monoclonal antibody | TSLP | Moderate-to-severe asthma | Potential for twice-yearly dosing | |||||||

| AIO-001 | Monoclonal antibody | TSLP | Chronic obstructive pulmonary disease | Potential for twice-yearly dosing | |||||||

| AIO-001 | Monoclonal antibody | TSLP | Chronic spontaneous urticaria | Potential for twice-yearly dosing |

Highlights and risks

Potential best-in-class TSLP antibody due to potential for twice-yearly dosing

Clinically validated mechanism of action based on Tezspire's (TSLP mAb) 2021 FDA approval

Lead asset in Phase 2 with positive Phase 1 and preclinical data

Commercial validation with Tezspire generating $133M quarterly revenue with 39% quarter-over-quarter growth in second year of launch

Potential for indication expansion into other large markets like COPD

Strong syndicate and management team including former CEO of Gilead, blue chip biotech VCs, and management that recently sold Gyroscope for over $800M upfront + biobucks

Strategic value: derisked assets with demonstrated best-in-class potential and attractive indication expansion opportunities are attractive acquisition targets

The company is entering high-risk Phase 2 studies. While the mechanism is validated and Phase 1 data is positive, twice-yearly dosing poses a risk, and there is always inherent risk in any study

There is already one approved TSLP antibody, so AIO-001 would need to demonstrate better clinical data to command the highest valuation

The company is likely valued in the $400-500M range. If AIO-001 does not show blockbuster potential in Phase 2 (even if the trial is positive), this valuation could provide an overhang

The company states that Phase 1 data and preclinical data are positive and suggest potential for twice yearly dosing, but no data from these trials appears to be publicly available

Valuation

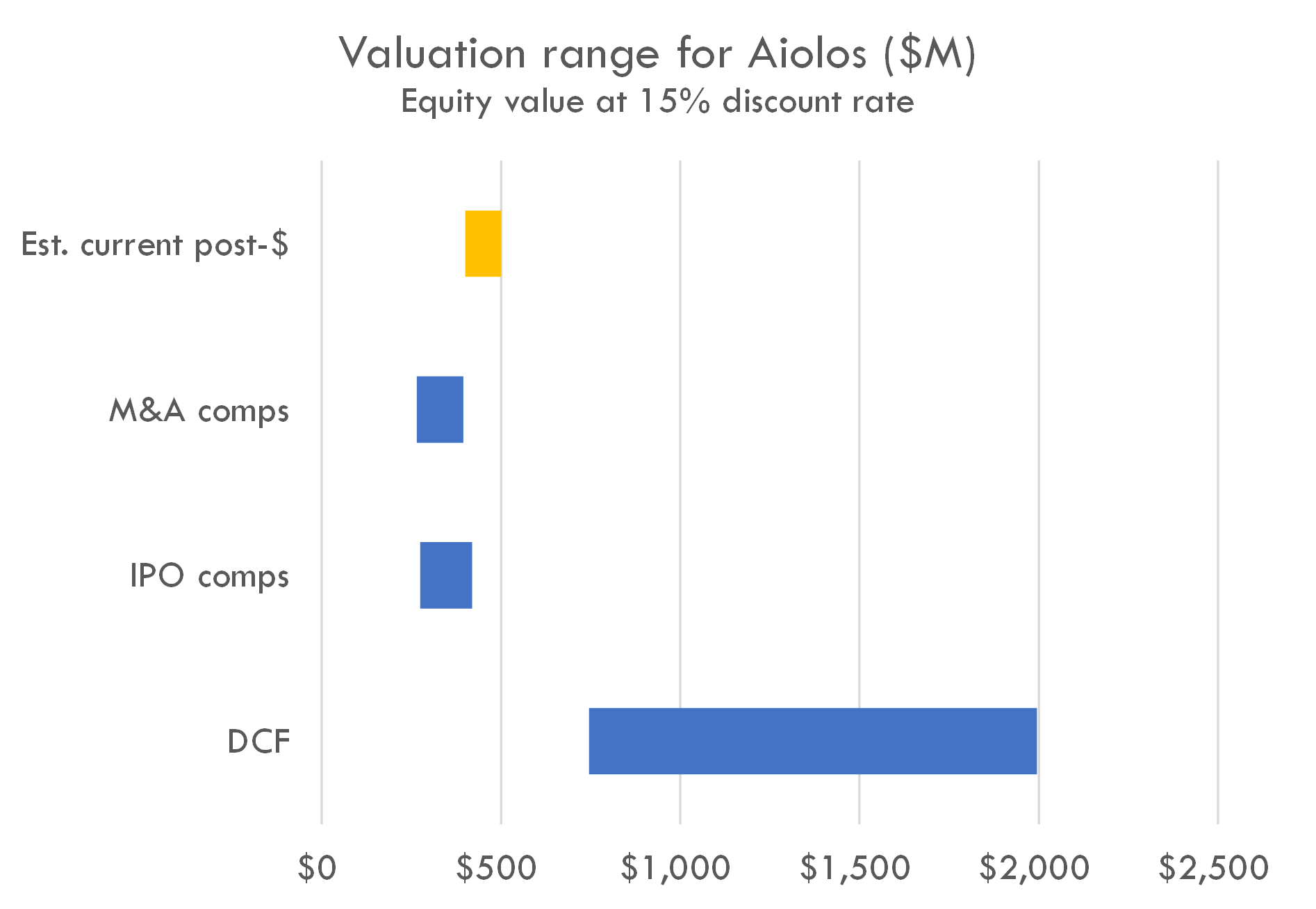

The company raised a $245M Series A in Oct 2023. Series A deals of that size often take 50-60% of total equity, implying a post-money in the $400-500M range (although valuations ranging from $300-700M are supported by some precedent transactions).

The company's estimated post-money valuation is slightly higher than the range suggested by IPO and M&A comps, but lower than the value suggested by the DCF. Editor's note: This may be a function of the tight IPO market, as one of the inputs to the valuation model is probability of IPO. The high DCF is driven by the AI projecting peak penetration of 5-15% of moderate-to-severe asthma patients, higher than average Phase 2 and 3 probability of success, and its estimates of clinical trial duration in asthma. It is likely that investors view this company as one that could be near the top of the IPO queue if markets reopen, but our model doesn't appear to capture that nuance at the moment.

Pipeline analysis

Scientific thesis

TSLP, or thymic stromal lymphopoietin, is a protein that plays a critical role in the maturation of T cell populations through activation of antigen presenting cells. It is implicated in the pathogenesis of several diseases, including asthma, atopic dermatitis, and allergic reactions. Due to its involvement in these conditions, TSLP has been a target for therapeutic interventions.

TSLP antibodies bind to TSLP, preventing it from interacting with its receptor. This in turn reduces the downstream signaling cascade that TSLP is involved in, helping to ameliorate symptoms in diseases where TSLP plays a pathological role. Here's an overview of TSLP antibodies and their therapeutic potential:

- Asthma: Elevated levels of TSLP have been observed in the airways of patients with asthma. Targeting TSLP with antibodies can potentially reduce asthma symptoms and exacerbations.

- Atopic Dermatitis: This skin condition, characterized by red, itchy rashes, has also been linked to elevated levels of TSLP. TSLP antibodies might reduce the inflammation and itching associated with atopic dermatitis.

- Allergic Diseases: Since TSLP is involved in the activation and maturation of dendritic cells which subsequently influence T cell responses, TSLP antibodies might be useful in treating various allergic responses.

Tezepelumab validates mechanism in asthma

Tezepelumab, a human monoclonal antibody targeting TSLP, was assessed for its efficacy and safety in a phase 3, double-blind, placebo-controlled trial involving patients with severe, uncontrolled asthma. 1061 participants, aged between 12 and 80, were randomized to receive either tezepelumab (210 mg) or a placebo every 4 weeks for a year. The primary measure was the annualized rate of asthma exacerbations over the 52-week period.

Results showed:

- A significant reduction in asthma exacerbations in the tezepelumab group (annualized rate of 0.93) compared to the placebo group (2.10), representing a rate ratio of 0.44.

- Among patients with blood eosinophil counts below 300 cells per microliter, the annualized exacerbation rate was 1.02 for the tezepelumab group and 1.73 for the placebo group.

- At the end of the 52-week period, tezepelumab-treated patients experienced greater improvements in prebronchodilator forced expiratory volume in 1 second (FEV1), scores on the Asthma Control Questionnaire–6 (ACQ-6), Asthma Quality of Life Questionnaire (AQLQ), and Asthma Symptom Diary (ASD) than those in the placebo group.

- The occurrence and nature of adverse events were similar between both groups.

In conclusion, tezepelumab proved beneficial for patients with severe, uncontrolled asthma, resulting in fewer exacerbations and improved lung function, asthma control, and health-related quality of life compared to placebo.

AIO-001 Program for Asthma

The successful results of the tezepelumab study have favorable implications for the clinical development of AIO-001, another TSLP monoclonal antibody:

- Validation of Target: The efficacy of tezepelumab in reducing asthma exacerbations and improving various clinical outcomes underscores the therapeutic potential of targeting TSLP in asthma. This can bolster the rationale for developing AIO-001, which also targets TSLP.

- Potential for Improved Dosing: If AIO-001 can be effectively administered twice-yearly, it may offer a significant advantage in terms of patient compliance and convenience compared to treatments requiring more frequent dosing, such as tezepelumab's monthly administration.

- Competitive Landscape: The success of tezepelumab also indicates that there's a market opportunity for effective TSLP inhibitors. If AIO-001 can demonstrate similar or superior efficacy and safety with its less frequent dosing, it could position itself as a competitive alternative in the asthma treatment landscape.

- Guidance for Clinical Endpoints: The endpoints used in the tezepelumab study (e.g., exacerbation rates, FEV1, and patient-reported outcomes) can serve as a reference for what might be expected or targeted in Phase 3 trials of AIO-001.

However, while these implications are positive, it's essential to recognize that drug development carries inherent uncertainties. The performance of one drug (tezepelumab) doesn't guarantee the success of another (AIO-001), even if they target the same pathway. AIO-001's unique properties, dosing regimen, and potential side effects will need thorough evaluation in its own clinical trials.

Information about the Phase 2 program for AIO-001 is not available. Based on tezepelumab's development, we can infer a potential Phase 2 study design for AIO-001 in moderate to severe asthma:

- Study Design: Multicenter, randomized, double-blind, placebo-controlled trial.

- Population: Adults and adolescents with moderate to severe, uncontrolled asthma. Age range might be similar to the Phase 3 trial (12 to 80 years) or may focus on a narrower age bracket.

- Intervention: Patients would be randomly assigned to receive AIO-001 or a placebo. Given AIO-001's potential for twice-yearly administration, patients might receive injections twice over the study duration. The exact dosage would be based on previous Phase 1 findings and early Phase 2 results.

- Number of Patients: For a Phase 2 study, the number of enrolled patients might be fewer than a Phase 3 trial. Depending on the aims and resources, enrollment could range from 100 to several hundred patients.

- Primary Endpoint: A common primary endpoint for Phase 2 asthma studies is the change from baseline in the forced expiratory volume in 1 second (FEV1) over a set period, often 24 weeks or the duration of the study.

- Key Secondary Endpoints:

- Annualized rate of asthma exacerbations: Though this was the primary endpoint in the Phase 3 trial for tezepelumab, it could be a secondary endpoint in Phase 2.

- Scores on the Asthma Control Questionnaire-6 (ACQ-6).

- Scores on the Asthma Quality of Life Questionnaire (AQLQ).

- Scores on the Asthma Symptom Diary (ASD).

- Safety and tolerability assessments.

- Pharmacokinetics and pharmacodynamics of AIO-001.

- Timeline: Given AIO-001's twice-yearly administration, a Phase 2 study duration might be approximately 6 months (24 weeks) to evaluate its short-term efficacy and safety. Including patient recruitment, data analysis, and interim evaluations, the entire study might last around 9-12 months from initiation to reaching the primary endpoint.

Industry-wide studies suggest probability of Phase 2 success of 20-30% and Phase 3 success of 65% for similar programs. Given the positive data from tezepelumab, a similar TSLP targeting mAb, the risk associated with Phase 2 could be somewhat reduced. While it's challenging to quantify precisely, let's assume the de-risking effect increases the PoS by 10-15 percentage points. This would result in a revised Phase 2 PoS of approximately 30% to 45% for AIO-001.

By the time a drug progresses to Phase 3, many of the scientific and clinical uncertainties have been addressed, making the influence of prior drugs (like tezepelumab) on PoS somewhat less pronounced. Still, the success of a similar mechanism of action can help in designing robust trials and targeting the right patient populations, which can improve the odds of success. Assuming a modest increase of 5-10 percentage points due to the de-risking effect of tezepelumab's success, the revised PoS for Phase 3 would be in the range of 70% to 75%.

It's important to note that these estimates are still speculative. The exact PoS would depend on various factors, including the specific characteristics of AIO-001, the trial design, the patient population chosen, and the endpoints selected. Moreover, while the success of tezepelumab provides a favorable precedent, each drug has unique properties and challenges that can influence its clinical development outcomes.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.

AIO-001 risks in asthma

The tezepelumab study provides valuable insights into the clinical development of TSLP monoclonal antibodies for treating severe, uncontrolled asthma. Here are potential clinical risks that the AIO-001 program might face:

- Efficacy in Different Subgroups: While tezepelumab demonstrated overall efficacy in reducing asthma exacerbations, it had a less profound effect in patients with a blood eosinophil count of less than 300 cells per microliter. If AIO-001 also targets a similar population, there might be variability in the therapeutic response depending on the eosinophil count, leading to potential challenges in identifying the best patient population for treatment.

- Duration of Effect: As AIO-001 is being developed for twice-yearly administration, it needs to demonstrate sustained efficacy over a more extended period compared to tezepelumab's monthly administration. Ensuring consistent therapeutic levels and sustained patient benefit over six months might be challenging.

- Safety Profile: While tezepelumab's adverse events did not differ meaningfully from the placebo, AIO-001 will need its own rigorous safety evaluations. Any monoclonal antibody can introduce unforeseen side effects, immune responses, or interactions, especially when administered less frequently.

- Comparison with Existing Therapies: With tezepelumab already on the market and showing robust clinical benefits, AIO-001 would likely face direct comparisons in terms of efficacy, safety, and convenience (e.g., dosing frequency). Meeting or exceeding the established benefits of tezepelumab will be crucial for AIO-001's competitive positioning.

- Patient Adherence and Administration: As AIO-001 aims for twice-yearly administration, ensuring patient adherence to this schedule and the practicalities of such infrequent dosing need consideration. Missed doses could have more significant ramifications for therapeutic outcomes compared to more frequently dosed treatments.

- Generalizability of Results: Like any clinical trial, results from tezepelumab studies might not be directly transferable to all patient populations, especially if there are ethnic, genetic, or environmental factors that influence treatment outcomes. AIO-001's trials would need a diverse cohort to ensure broad applicability.

- Regulatory Scrutiny: Regulatory agencies might apply increased scrutiny to AIO-001, given the existence of an approved drug with the same mechanism of action. Demonstrating distinct advantages or at least non-inferiority will be crucial.

- Commercial Risks: As AIO-001 will reach the market after tezepelumab, there's a potential for slower uptake, given physicians' familiarity with tezepelumab. The developers would need a clear market strategy highlighting AIO-001's unique advantages.

AIO-001 market opportunity

Asthma is a chronic inflammatory disorder of the airways characterized by variable and recurring symptoms, airflow obstruction, bronchial hyperresponsiveness, and an underlying inflammation. The severity of asthma is often categorized into intermittent and mild, moderate, or severe persistent asthma, based on the frequency of symptoms, nighttime awakenings, and lung function.

Moderate Persistent Asthma: Symptoms during the day more than once a week but not every day, nighttime symptoms more than once a week but not daily, and minor limitation with normal activities.

Severe Persistent Asthma: Symptoms throughout the day on most days, frequent nighttime symptoms, and extreme limitation with normal activities.

- Current Standard of Care

- Inhaled Corticosteroids (ICS): These are the cornerstone of asthma management. They reduce inflammation in the airways.

- Long-acting beta-agonists (LABAs): Often combined with ICS, LABAs help to relax and open the airways.

- Leukotriene Modifiers: These are oral medications that help reduce asthma symptoms by interrupting the inflammatory process.

- Biologics: For severe asthma that doesn't respond to standard treatments, biologic drugs like omalizumab (Xolair), mepolizumab (Nucala), reslizumab (Cinqair), benralizumab (Fasenra), and dupilumab (Dupixent) target specific molecules and cells that cause or contribute to inflammation in asthma.

- Oral Corticosteroids: For severe symptoms or exacerbations, these can be prescribed but come with more potential side effects over long-term use.

- Bronchodilators: Quick-relief or rescue medications like albuterol help to quickly relax and open the airways during an asthma attack.

The tezepelumab Phase 3 focuses on patients with severe asthma that is uncontrolled, suggesting that tezepelumab is intended for patients who may not respond sufficiently to standard treatments like ICS or LABAs. This places tezepelumab as a potential treatment option for patients in need of more potent interventions.

- Unmet need

- Safety and Side Effects: Long-term use of oral corticosteroids can lead to significant side effects. There's a need for treatments that are both effective and have a better safety profile.

- TSLP mAb role: Based on the Phase 3 study of tezepelumab, the "frequencies and types of adverse events did not differ meaningfully between the two groups." This suggests that tezepelumab has a similar safety profile to the placebo, addressing the need for treatments with better safety profiles.

- Treatment Response: Not all patients respond well to current treatments, and some may experience frequent exacerbations despite therapy.

- TSLP mAb role: Tezepelumab notably reduced the annualized rate of asthma exacerbations, showing it's effective in preventing exacerbations in patients with severe, uncontrolled asthma. Specifically, patients on tezepelumab had fewer than half the exacerbations of those on placebo (0.93 vs. 2.10), representing a significant reduction.

- Disease Modification: While current treatments manage symptoms and prevent exacerbations, they don't necessarily alter the underlying disease course. There's a need for therapies that can modify or halt disease progression.

- TSLP mAb role: Tezepelumab led to better lung function (as measured by prebronchodilator FEV1), suggesting potential modifications in the disease course or at least better management of symptoms.

- Convenience: Daily medications can be burdensome for patients, leading to non-adherence. Treatments with less frequent dosing or longer-lasting effects can address this gap.

- TSLP mAb role: Tezepelumab is administered subcutaneously every 4 weeks, which is comparable to other biologics in terms of dosing frequency. While it may not directly address the convenience need for less frequent dosing, its effectiveness might outweigh this aspect for many patients. AIO-001 may provide even further benefit with its twice-weekly dosing.

- Specific Patient Populations: Certain subsets of asthma patients, such as those with non-eosinophilic asthma or those who smoke, have fewer effective treatment options.

- TSLP mAb role: Tezepelumab was effective in patients with blood eosinophil counts of less than 300 cells per microliter. This suggests tezepelumab might be effective across diverse patient subpopulations, including those that may not be eosinophilic-dominant, which is a significant advantage.

- Comorbidities: Asthma often exists with other conditions like allergies, nasal polyps, or eczema. Comprehensive treatments that can address both asthma and its common comorbidities are needed.

- Quality of life

- TSLP mAb role: Tezepelumab showed significant improvements in asthma control and health-related quality of life, as reflected in scores on the ACQ-6, AQLQ, and ASD. This highlights its potential in not only managing the disease but improving overall patient well-being.

The market opportunity for a novel treatment like AIO-001 in moderate-to-severe asthma can be substantial, given the prevalence of the disease, the unmet needs in treatment, and the financial performance of similar drugs in the market.

- Revenue build

- Tezepelumab was approved in December 2021 and generated $133M in global sales in Q2 2023 with a 39% quarter-over-quarter growth rate. This rapid uptake suggests a significant demand for innovative treatments, especially those targeting TSLP, and highlights the potential market opportunity for AIO-001.

- Total Addressable Market

- For context, globally, asthma affects over 300 million people. If even 10% of these patients have moderate-to-severe asthma, that's a potential pool of 30 million patients.

- The prevalence of asthma in the United States has fluctuated over the years, but it's estimated that approximately 8% of the U.S. population has asthma. This translates to roughly 25 million people.

- Moderate-to-severe asthma typically affects a subset of those diagnosed with asthma. The exact proportion can vary based on various factors, including definitions, patient populations studied, and geographic and environmental considerations.

- However, based on clinical literature and the prevalence in different patient populations, it's generally estimated that about 5-10% of asthma patients have moderate-to-severe disease that is uncontrolled despite standard therapies. So, between 1.32 to 2.64 million people in the U.S. might have moderate-to-severe asthma.

- Market Penetration

- Not all of these patients will be on AIO-001. Factors influencing market penetration include drug efficacy, safety profile, physician adoption, patient awareness, pricing, and insurance coverage.

- For simplicity, if we estimate a 10% peak market penetration, that would mean 198,000 patients.

- Pricing

- Tezepelumab's price is $3,847.35 per dose every 4 weeks, which translates to an annual cost of $50,216.10 (13 doses per year).

- Assuming the annual price of AIO-001 is similar to tezepelumab, so $50,216.10.

- Peak US revenue

- Gross revenue: 198,000 patients * $50,216.10 = $9,942,788,800 (or approximately $9.94 billion).

- With a conservative 30% gross-to-net adjustment, the net revenue would be 70% of the gross revenue = $6.96 billion

AIO-001 in other indications

AIO-001 is also in preclinical development for chronic obstructive pulmonary disease (COPD) and chronic spontaneous urticaria (CSU).

COPD

Chronic obstructive pulmonary disease (COPD) is a progressive lung disease characterized by chronic inflammation, airway remodeling, and airflow limitation. While the etiology of COPD primarily centers on exposure to cigarette smoke and other environmental pollutants, the inflammatory cascade that propels COPD progression involves a variety of immune mediators and cell types.

- Rationale for Targeting TSLP in COPD

- Bridge between Innate and Adaptive Immunity: TSLP serves as a bridge between innate immune responses (which immediately respond to harmful stimuli) and adaptive immunity (which is more specific and can "remember" past exposures). By targeting TSLP, there's potential to modulate both arms of the immune response, which might be particularly useful in diseases where both these arms play roles, such as COPD.

- Overlap with Asthma Mechanisms: While COPD and asthma are distinct diseases, there is a recognized overlap in certain patients, often referred to as the 'asthma-COPD overlap syndrome' (ACOS). Some of the inflammatory mechanisms seen in asthma are also observed in these overlap patients. Given the efficacy of TSLP-targeting in asthma, there's a rationale to investigate its effects in COPD or ACOS.

- Potential Anti-inflammatory Effect: Chronic inflammation is a hallmark of COPD, and TSLP has been implicated in promoting Th2 (a subtype of T cells) mediated inflammation. Inhibiting TSLP might reduce the persistent inflammation seen in COPD patients, especially in those with a higher Th2 profile.

- Airway Remodeling: Beyond inflammation, airway remodeling (structural changes in the airways) is a significant concern in COPD. As TSLP is implicated in the epithelial-mesenchymal transition (EMT) - a process connected to airway remodeling - targeting TSLP might have benefits in preventing or reversing these structural changes.

- Exacerbations: COPD exacerbations, which are acute worsening of symptoms, significantly impact morbidity and mortality in COPD patients. Given that TSLP levels have been found to be elevated during exacerbations in some studies, targeting TSLP could potentially reduce the frequency or severity of these events.

- Standard of care

- Bronchodilators:

- Short-Acting Bronchodilators: Include short-acting beta2-agonists (SABAs) like albuterol and short-acting muscarinic antagonists (SAMAs) like ipratropium.

- Long-Acting Bronchodilators: Primary maintenance therapies for COPD.

- Long-Acting Beta2-Agonists (LABAs): Examples include salmeterol, formoterol, and olodaterol.

- Long-Acting Muscarinic Antagonists (LAMAs): Examples include tiotropium, aclidinium, and glycopyrronium.

- Inhaled Corticosteroids (ICS): Used mainly for patients with a history of exacerbations or asthma-COPD overlap.

- Phosphodiesterase-4 (PDE-4) Inhibitors: Roflumilast is indicated for certain severe COPD patients.

- Mucolytic Agents: Agents like N-acetylcysteine help thin mucus.

- Oxygen Therapy: Used for patients with low blood oxygen levels.

- Pulmonary Rehabilitation: Includes patient education, exercise training, and counseling.

- Vaccinations: Annual flu shots and pneumococcal vaccine are recommended.

- Surgical Interventions:

- Lung Volume Reduction Surgery: Removes damaged tissue.

- Bullectomy: Removes large air spaces from the lungs.

- Lung Transplant: For patients who don't respond to other treatments.

- Non-invasive Ventilation (NIV): Used during exacerbations with respiratory failure.

- Endobronchial Valves: One-way valves inserted into the airways for select patients.

- Self-Management and Education: Education on managing exacerbations, breathing techniques, and more.

- Smoking Cessation: Vital for slowing the progression of COPD.

- Unmet need

- Disease Modification: Current treatments primarily alleviate symptoms and reduce exacerbations. There isn't a therapy that halts or reverses the disease's progression.

- Reduction of Exacerbations: Frequent exacerbations worsen patient quality of life, accelerate disease progression, and lead to hospitalizations. While some treatments reduce exacerbation frequency, many patients continue to experience frequent exacerbations.

- Safety and Tolerability: Current treatments, especially when used in combinations, can lead to side effects, and not all patients tolerate them well.

- Personalized Medicine: COPD's causes and progression can vary between individuals. Therapies tailored to individual patient characteristics or specific COPD subtypes are an unmet need.

- Comorbidities: COPD often coexists with other conditions like cardiovascular diseases, osteoporosis, depression, and more. Therapies that can simultaneously address COPD and its common comorbidities could offer significant benefits.

- Market opportunity

- Prevalence: COPD is the third leading cause of death worldwide. According to the World Health Organization, around 65 million people have moderate to severe COPD.

- Aging Population: The prevalence of COPD increases with age, and with the global population aging, the number of COPD cases is expected to rise, expanding the market opportunity.

- Limited Effective Therapies: Given the significant unmet need in COPD, any novel treatment that offers better efficacy, safety, or addresses specific disease subtypes can command significant market share.

- Global Reach: While the prevalence of COPD is high in developed countries due to historical smoking rates, there's a growing incidence in developing countries due to increasing tobacco use and exposure to environmental pollutants. This offers a diverse market opportunity.

- Healthcare Expenditure: Frequent exacerbations and hospitalizations associated with severe COPD lead to substantial healthcare costs. Therapies that reduce these can not only command a premium price but also get support from payers and healthcare systems due to the potential for overall cost savings.

- Chronic Treatment Regimen: COPD requires long-term management, and patients often remain on therapies for extended periods. This ensures sustained revenue for effective treatments.

However, it's essential to note that any therapeutic rationale is only as good as the clinical data supporting it. It's crucial to conduct rigorous clinical trials to determine the safety and efficacy of TSLP antibodies in COPD. Given that COPD has a different pathogenesis compared to asthma, it's not a guarantee that benefits seen in asthma will translate directly to COPD. COPD is a heterogeneous disease, with multiple phenotypes and endotypes. The therapeutic impact of TSLP antibodies might be more pronounced in certain subgroups of COPD patients than others.

CSU

Chronic spontaneous urticaria (CSU), also referred to as chronic idiopathic urticaria, is characterized by the recurrent appearance of hives (wheals) and/or angioedema for more than six weeks, without an identifiable external trigger. The pathogenesis of CSU is believed to involve both autoimmune and inflammatory components.

- Rationale for Targeting TSLP in Chronic Spontaneous Urticaria

- Involvement in Skin Inflammation: Epithelial cells in the skin can release TSLP in response to various stimuli, including tissue damage, infection, or exposure to allergens. Once released, TSLP can activate dendritic cells, mast cells, and T cells, promoting a cascade of events that can lead to inflammation and allergic reactions in the skin, potentially contributing to CSU's manifestations.

- Mast Cell Activation: Mast cells play a central role in CSU by releasing histamine and other inflammatory mediators. TSLP can enhance mast cell activation, which suggests that by targeting TSLP, one might dampen mast cell activity and reduce the symptoms of CSU.

- Potential Role in Autoimmunity: There's evidence suggesting that CSU has an autoimmune component in a subset of patients, where autoantibodies target IgE or the IgE receptor on mast cells and basophils, leading to their activation. TSLP is known to promote B-cell differentiation, which could indirectly contribute to autoantibody production. Thus, targeting TSLP might modulate this autoimmune aspect of CSU.

- Interplay with Other Cytokines: TSLP can induce the production of other pro-inflammatory cytokines and chemokines, enhancing the recruitment and activation of various immune cells in the skin. By targeting TSLP, this inflammatory loop could be interrupted.

- Overlapping Pathways with Atopic Dermatitis: There's evidence from atopic dermatitis (a chronic inflammatory skin condition with some shared features with CSU) that TSLP is overexpressed and contributes to disease pathogenesis. This provides further rationale for exploring TSLP-targeting therapies in other skin conditions, including CSU.

- Standard of Care in CSU:

- First-line treatments:

- Non-sedating Antihistamines: Drugs like cetirizine, loratadine, and fexofenadine. They reduce itching and hives appearance.

- Updosing of Antihistamines: Increased dose when standard dosing is ineffective.

- Second-line treatments:

- H1-Antihistamines: Higher doses or different types might be tried.

- H2-Antihistamines: Ranitidine or cimetidine might be added to therapy.

- Third-line treatments:

- Omalizumab (Xolair): An anti-IgE antibody for patients who don't respond to antihistamines.

- Corticosteroids: Short courses for acute exacerbations, but not for prolonged use.

- Fourth-line treatments:

- Cyclosporine: An immunosuppressant drug for non-responders to other therapies.

- Dapsone or Sulfasalazine: May benefit some patients.

- Unmet Need:

- Effective Treatments: A need for more potent and targeted therapies.

- Safety Profile: Concerns over side effects from chronic use of some medications.

- Treatment Response: Variable response to available treatments, especially antihistamines.

- Biomarkers: A need for predictors of treatment response.

- Understanding of Pathogenesis: More insights can guide specific and effective treatments.

- Market Opportunity:

- Growth in Biologics: Increasing interest in immune-targeted biologics for CSU.

- Large Patient Population: CSU affects 0.5% to 1% of the global population.

- Chronic Nature of Disease: CSU's recurring nature means patients often need long-term treatment.

- Increasing Awareness: Higher diagnosis rate and treatment-seeking due to greater awareness.

- Pipeline Developments: Drugs in the pipeline target various immune responses in CSU.

It is important to remember that the real test for any therapeutic rationale lies in clinical trials. The safety and efficacy of TSLP antibodies in CSU would need to be established through rigorous clinical studies.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.