AI equity research analyst: initiating coverage on Neumora Therapeutics (NMRA)

October 3, 2023

All of this text (except for this intro / disclaimer, current stock price and market data, and the ads) was generated by artificial intelligence. The accompanying DCF model was generated by software based on inputs provided by AI. A human provided the prompts for the AI, selected which responses to include in the final report, and formatted this web page. The images (except for the DCF model output) are drawn from Neumora Therapeutics' S-1 filing and added manually to the article.

This is not investment advice. All of the insights and analysis were generated by AI. We provided prompts to guide the AI to conduct analysis and write in the style of an investment research analyst, but we did not check any of the facts or analysis for accuracy. The only specific data we provided the AI was text from NMRA's S-1 filing. We do not have a position in NMRA, nor do we anticipate entering a position in the near-term. We have no relationship with the company or its investors. This is solely intended as an experiment to see how well AI tools can help with investment research.

Overview

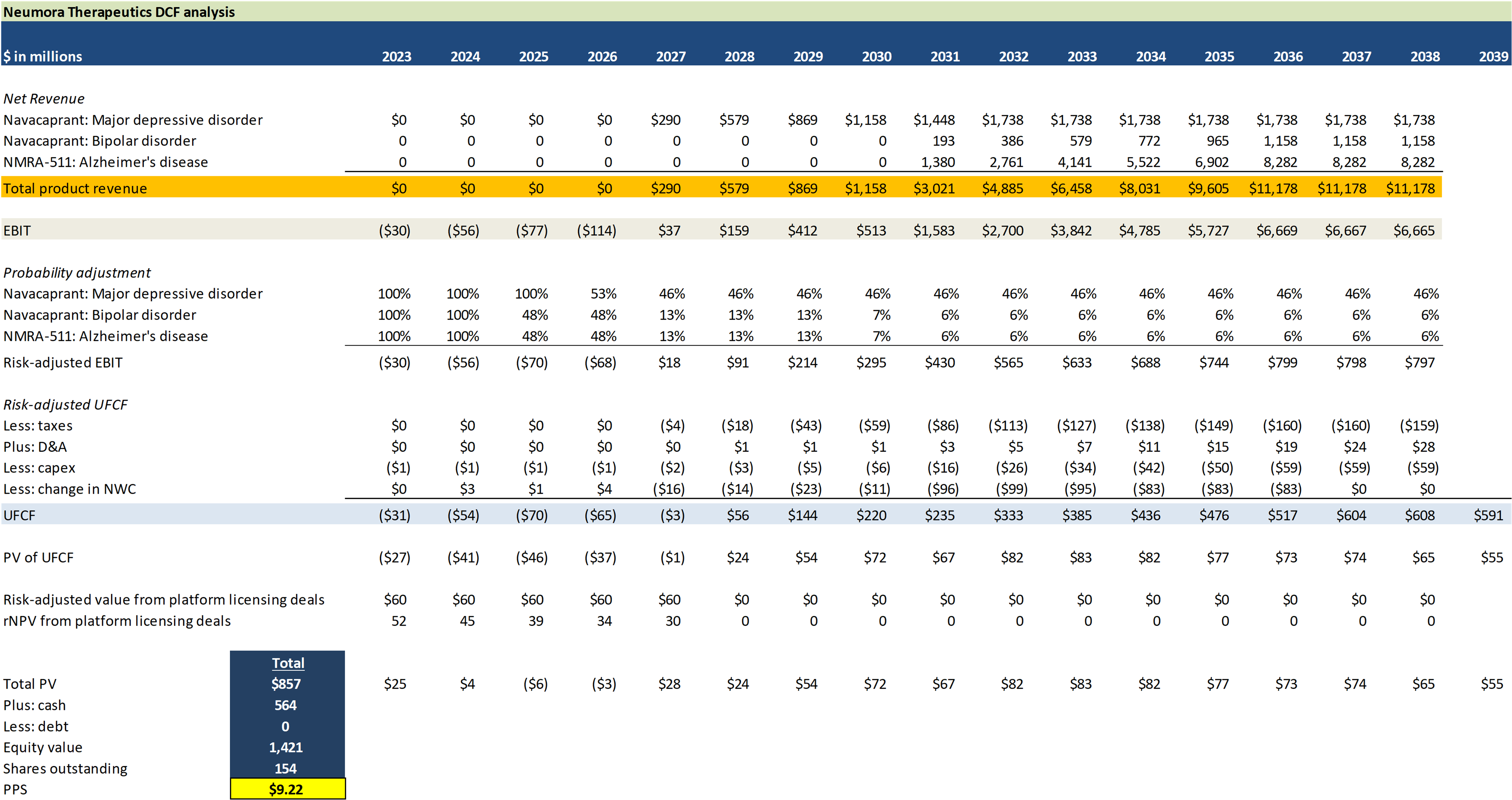

We're launching coverage on Neumora Therapeutics with a target price of $9. This clinical-stage biopharmaceutical company, endowed with $600 million funding, is poised to make a mark in the global brain disease arena with seven active neuroscience programs under its belt.

Price target: $9

Latest stock price: $11.91

IPO price: $17.00

IPO date: Sept 14, 2023

Performance since IPO: -30%

Market cap: $1.8B

Enterprise value: $1.2B

Cash: $0.6B

Runway through: 1H 2025

trading data current as of Oct 4, 2023

Highlights and risks

Navacaprant: A Front Runner for MDD: Navacaprant (NMRA-140), the lead candidate of the company, is in Phase 3 trials for Major Depressive Disorder (MDD) and has demonstrated potential. Phase 2 trials showed efficacy in patients with moderate to severe MDD, presenting a safety profile with few severe adverse side effects. Navacaprant, which targets the KOR/dynorphin system essential for mood regulation, may represent a significant development in MDD treatment. The results of the Phase 3 trials are expected by late 2024.

Notable Market Potential: Navacaprant aims to address anhedonia, a symptom often overlooked in MDD treatment, potentially offering a new therapeutic option for over 21 million adults in the US. Given that a substantial number of patients do not respond to current first-line therapies, Navacaprant may meet a notable market need, with the potential to achieve or exceed the revenues of previously successful MDD drugs.

Filling the Bipolar Disorder Gap: Seven million US adults are diagnosed with Bipolar Disorder, including a significant number with Bipolar II, a condition that presents substantial unmet medical needs. Navacaprant is under investigation for its potential effects on anhedonia, a challenging symptom to address, with preclinical and Phase 2 results providing preliminary support for its efficacy.

Promising Pipeline: With funding of $600 million, Neumora is progressing with a diversified neuroscience pipeline that consists of seven programs. The company is preparing for a critical phase, with multiple clinical trials set to commence in the next 12-18 months. Among the notable candidates is NMRA-511, which is under investigation for its potential to address anxiety, aggression, and stress through the antagonism of the Vasopressin 1a Receptor.

Key risks: Navacaprant in MDD faces risks such as historical Phase 3 failures in MDD due to high placebo response and challenges inherent in MDD trials. Its Phase 2 data holds potential limitations, including initial design misalignment targeting milder MDD patients and failure to achieve the primary endpoint in the original study's broader cohort. The later adjustment to include moderate to severe MDD patients introduces elements of post-hoc analysis, potentially complicating data interpretation. Furthermore, MDD diagnosis depends on subjective measures, which, alongside the absence of objective endpoints, might challenge Phase 3 reproducibility. While Navacaprant exhibited a favorable short-term safety profile, Phase 3 might reveal long-term risks. Lastly, Navacaprant must differentiate itself in efficacy and mechanism from emerging MDD treatments to ensure adoption upon potential approval.

For Bipolar disorder, Navacaprant’s efficacy is not guaranteed due to the distinct pathology and symptomatology between MDD and bipolar disorder, as current evidence primarily focuses on MDD. The investment thesis heavily relies on the hypothesized mechanism of action, assuming that improvements in anhedonia in MDD patients will translate to bipolar patients, which remains empirically unvalidated. Additionally, bipolar disorder's heterogeneous nature means responses to treatment can vary significantly across patient subgroups, and current data provides no insight into responses within these subgroups.

NMRA-511 is in early clinical development (Phase 1) with limited human efficacy data available. The promising preclinical findings have not yet been validated in clinical trials, and it's uncertain whether these findings will translate effectively into demonstrable patient benefits in subsequent trial phases.

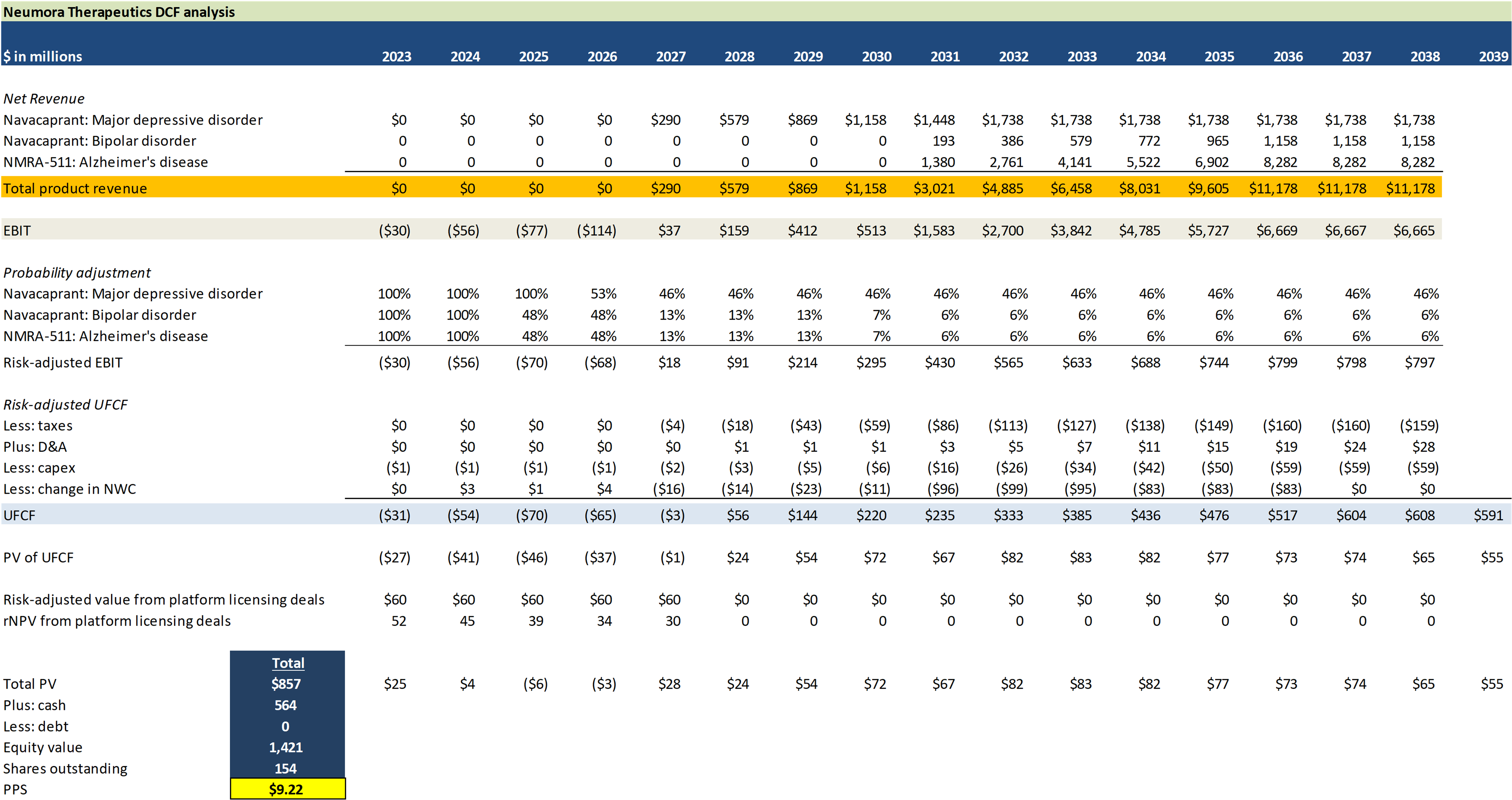

Valuation summary

Sensitivity analysis

Current value

New value 1

New value 2

New value 3

New value 4

New value 5

Current value

New value 1

New value 2

New value 3

New value 4

New value 5

$ in millions, except drug price

DCF assumptions overview

Navacaprant

- Pricing Estimate: Navacaprant is projected to be priced between $8,640 and $9,360 per patient per year.

- Price Adjustment Calculation for Attrition Factors

- Non-adherence: Estimated at 50%, based on WHO data for chronic diseases, significantly impacting yearly revenue per patient.

- Recovery: With 30-40% remission rates, assume 35% of patients won't contribute to full annual revenue due to recovery.

- Ineffectiveness: 20% of patients might not respond effectively, contributing only partially to yearly revenue.

- Adjusted price considering attrition: Estimated expected revenue per patient per year is $2,433.60.

- MDD Peak Adoption (Years 5-7): Navacaprant is expected to capture 10% of the moderate to severe MDD market. This translates to treatment for approximately 840,000 patients.

- Bipolar Market Share Estimates: Initial 1-2%, growing to 5-8% at peak.

NMR-511

- Pricing for NMRA-511: Estimated premium price is around $1,800/month.

- Effective annual price per patient, considering attrition factors: approximately $12,737.28.

- Patient Attrition Factors:

- Non-adherence: 20-30%.

- Symptom resolution: 5-10%.

- Drug ineffectiveness: 10-20%.

- Market Size and Share: Target market: approximately 5.1 million Alzheimer’s patients experiencing agitation (76% of 6.7 million total).

- Peak market share expected: 10-20%.

Preclinical programs and Precision Toolbox Platform

- Licensing Fee per Deal: $20 Million (hypothetical; depends on deals company might make)

- Number of Expected Licensing Deals: 3 over next 5 years (hypothetical)

- Discount Rate: 15% (industry average for high risk)

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.

Company overview

Neumora Therapeutics, targeting brain diseases, is at the clinical stage with a focus on meeting the needs of 1.5 billion global patients. With $600 million in funding, the firm is developing seven neuroscience programs for various neuropsychiatric and neurodegenerative conditions. Its lead candidate, navacaprant (NMRA-140), a Phase 3 daily oral treatment for Major Depressive Disorder (MDD), offers an alternative to traditional serotonin-focused therapies, with top-line results expected in late 2024. Neumora employs innovative mechanisms through its programs and utilizes its Precision Toolbox, integrating machine learning and patient data to improve trial designs and create patient-aligned treatments, aiming to redefine neuroscience drug development.

With a business strategy grounded in precision neuroscience, the company focuses on the development of novel therapies for diverse neuropsychiatric and neurodegenerative disorders. Here’s an outline of Neumora's strategic approach:

- Broad Pipeline: Neumora has built a pipeline of seven programs in various development stages, from preclinical to late-stage clinical, focusing on novel neuroscience therapeutics. The lead program, navacaprant, is an oral daily medication poised for Phase 3 trials for Major Depressive Disorder (MDD), with top-line results expected in late 2024.

- Capital Allocation: The company has garnered substantial capital resources, supporting its diverse therapeutic pipeline. Through strategic capital allocation, Neumora seeks to establish proof-of-concept for its programs, aiming to increase their probability of success

- Precision Toolbox: Neumora's Precision Toolbox integrates data science and translational neuroscience tools to better understand brain diseases and identify responsive patient populations. This toolbox supports the development of the company's novel therapeutics and aids in optimizing clinical trial designs.

- Intellectual Property (IP): Neumora's strong IP position for each program, backed by long-dated patents, allows the company to realize the full value of their programs while maintaining a strategic advantage.

Over 1.5 billion people worldwide suffer from neurological conditions, creating an $80 billion revenue market in 2020. Despite this vast market, current treatments often fall short in efficacy and diversity, addressing symptoms rather than underlying genetic and biological mechanisms. The majority of neuropsychiatric and neurodegenerative patients remain underserved due to these limitations in existing treatments.

Despite significant investments in neuroscience (over $110 billion spent in the U.S. alone since 2019), the field has witnessed limited drug approvals for brain diseases. Clinical development success rates are low, even with considerable R&D expenditures.

With over $600 million in funding, Neumora aims to confront the global brain disease crisis by developing a suite of therapies targeting the diverse patient population suffering from these conditions. The company is particularly focused on introducing therapies with novel mechanisms of action that stand distinct from currently approved treatments, providing both physicians and patients with more effective and safer treatment options. The strategic focus is on not just advancing a single program but envisioning holistic treatment approaches for the global patient population suffering from brain diseases.

Get more articles like this...

...by joining our mailing list. Check out our other articles to see if our content is a good fit for you.

Neumora Therapeutics Pipeline Overview

Through a blend of internal discoveries and strategic collaborations, Neumora Therapeutics has developed a diverse therapeutic pipeline targeting both neuropsychiatric disorders and neurodegenerative diseases.

Neumora Therapeutics plans to initiate several clinical trials across these programs over the next 12-18 months, marking an exciting phase for the company.

- Navacaprant (NMRA-140)

- Use: Treatment for major depressive disorder (MDD) and potential applications in bipolar depression, schizophrenia, PTSD, anxiety, ADHD, and substance use disorder.

- Development stage: Entering Phase 3 program with three efficacy studies. Topline results for KOASTAL-1 study expected in 2H 2024.

- Comment: A once-daily oral medication focusing on the dopamine and reward processing pathways.

- NMRA-511

- Use: Targets multiple neuropsychiatric disorders and neurodegenerative diseases, especially anxiety, aggression, and stress.

- Development stage: Currently in Phase 1. Plans to start a trial for agitation in Alzheimer's patients in 1H 2024.

- Comment: Antagonist of the vasopressin 1a receptor (V1aR).

- NMRA-266

- Use: Treatment for schizophrenia and other neuropsychiatric disorders. Potential in dementia-related psychosis and cognitive disorders.

- Development stage: Preclinical with an IND submission planned for Q4 2023.

- Comment: Positive allosteric modulator of the M4 muscarinic receptor (M4R). Exclusively licensed from Vanderbilt University.

- NMRA-NMDA

- Use: Treatment for schizophrenia (SCZ).

- Development stage: Preclinical.

- Comment: NMDA positive allosteric modulator program. Internally discovered with a unique binding site targeting.

- NMRA-CK1d

- Use: Treatment for amyotrophic lateral sclerosis (ALS).

- Development stage: Preclinical.

- Comment: CK1d inhibitor program targeting TDP-43-driven pathology. Exclusively licensed from Amgen Inc.

- NMRA-NLRP3

- Use: Treatment for neurodegenerative conditions, particularly Parkinson’s disease (PD).

- Development stage: Preclinical.

- Comment: Inhibitor program targeting the NLRP3 inflammasome, which is activated in brain microglia.

- NMRA-GCase

- Use: Treatment for Parkinson’s disease (PD) focused on addressing lysosomal dysfunction.

- Development stage: Preclinical.

- Comment: Activator program elevating the activity of the enzyme glucocerebrocidase (GCase). Exclusively licensed from Amgen.

Pipeline analysis

Navacaprant (NMRA-140): MDD

Navacaprant (NMRA-140) is an oral once-daily medication being developed as a selective KOR antagonist. This compound targets the KOR/dynorphin system, a pathway that modulates depression, anhedonia, and anxiety. By specifically antagonizing the KOR, navacaprant is designed to modulate dopamine and reward processing pathways, which are vital in regulating mood, cognition, reward, and behavior. From a biological standpoint, the KOR/dynorphin system's well-characterized role in mood disorders suggests a promising approach for navacaprant in addressing depression. Clinically, with many adults diagnosed with MDD not responding adequately to first-line treatments, this novel mechanism offers a potential new avenue of treatment that could meet significant unmet medical needs.

Mechanism of Action and Rationale

The kappa-opioid receptor (KOR) and its endogenous ligand, dynorphin, are increasingly recognized for their role in the neural regulation of mood and emotional responses:

- Role in Stress and Negative Affect: Stress is a major precipitant of depression. The KOR/dynorphin system is activated in response to stress. Activation of KOR by dynorphin tends to produce dysphoric or negative mood-like effects in both humans and animals.

- Animal Studies: Studies in rodents have shown that activation of the KOR can lead to behaviors analogous to human depressive symptoms, such as increased immobility in the forced swim test (a classic behavioral despair model). Conversely, KOR antagonists (which block the receptor's activity) have shown antidepressant-like effects in these same animal models.

- Human Studies: While studies directly linking KOR to MDD in humans are fewer than animal studies, there is evidence to suggest the relevance of this system in mood disorders. For instance, a PET imaging study has shown altered KOR binding in individuals with depression.

- Therapeutic Implications: Given the aforementioned data, KOR antagonists have been considered as potential novel antidepressants. They would act differently than traditional SSRIs, which primarily modulate the serotonin system.

- Dysphoria and Drug Abuse: Beyond depression, the KOR system is implicated in the dysphoric and pro-depressive effects of drugs of abuse, like cocaine. Drug-induced activation of the KOR/dynorphin system might contribute to the negative emotional states associated with drug withdrawal and contribute to relapse.

- Safety and Side Effects: It's also worth noting that while KOR antagonists may be promising, like all drugs, they come with potential side effects. Given that the opioid system at large is involved in many physiological processes, it will be essential to ensure the specificity of KOR antagonists and avoid undesired effects.

- Emerging Treatments: There are a number of pharmaceutical companies that have shown interest in developing KOR antagonists or modulators as potential treatments for depression and other mood disorders, given the promising early results in preclinical and clinical studies.

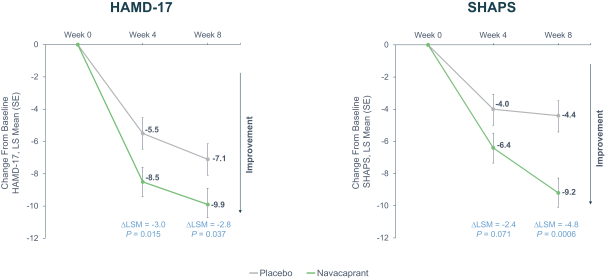

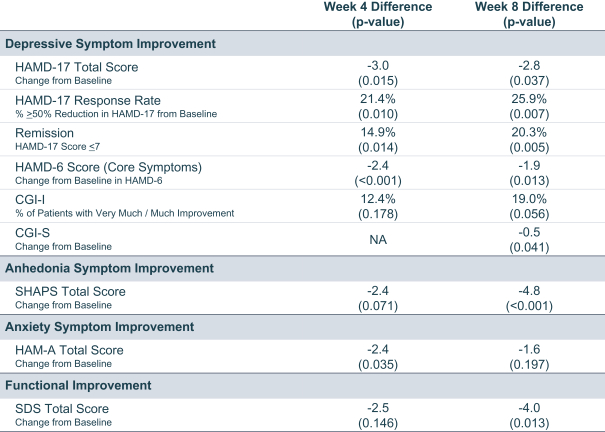

Anhedonia, the diminished ability to experience pleasure, is a major component of MDD that has been historically overlooked in treatment development. Navacaprant uniquely addresses anhedonia, standing out from existing treatments and serving a significant, previously underserved patient demographic. It not only holds promise for treating general MDD symptoms but specifically impacts anhedonia, as evidenced by the SHAPS. Given the compelling preliminary data, including findings from animal models, continued research and rigorous human clinical trials are essential to verify the safety, efficacy, and therapeutic value of targeting the KOR/dynorphin system with navacaprant.

Clinical development

Following a positive Phase 2 meeting with the FDA, the company has advanced into a Phase 3 program with three efficacy studies: KOASTAL-1, KOASTAL-2, and KOASTAL-3. Topline results for KOASTAL-1 are expected in the second half of 2024, providing a near-term milestone for investors and stakeholders.

The three separate studies aim to demonstrate not just efficacy but also the consistency of Navacaprant's results, considering historical challenges in replicating MDD drug successes in later stages. Given past Phase 3 failures of other MDD treatments due to uncontrolled placebo effects, Navacaprant's Phase 3 design likely incorporates strategies for rigorous control, possibly through improved patient selection, advanced monitoring, and methods like placebo run-in periods.

The focus on moderate to severe MDD increases the chances of showcasing clear efficacy, as treatments for mild MDD often face a pronounced placebo response.

Phase 2 data: strengths

Targeted Patient Population: One of the significant strengths of the Phase 2 study lies in its amendment to include moderate to severe MDD patients, reflecting a more clinically pertinent demographic. This decision to pivot aligns with their proposed Phase 3 program and also recognizes the increased challenges in demonstrating efficacy in milder cases due to the pronounced placebo effect.

Significant Efficacy Demonstrated: Across a range of measures – HAMD-17, SHAPS, HAMD-6, CGI-I, CGI-S, HAM-A, and SDS – navacaprant consistently showed statistically significant treatment differences compared to placebo in the moderate to severe MDD cohort. This comprehensive efficacy portrayal across multiple metrics in Phase 2 strengthens the drug's potential for Phase 3 success.

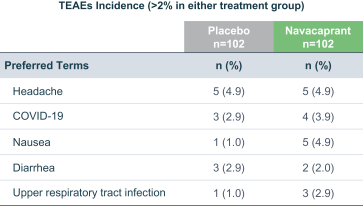

Safety Profile: Notably, navacaprant exhibited a superior safety profile. The lower overall discontinuation rates, especially related to treatment emergent adverse events (TEAEs), in comparison to placebo, are remarkable. The absence of commonly concerning side effects like weight gain, sexual dysfunction, or suicidal behavior is compelling and will likely enhance its appeal to both physicians and patients.

Phase 2 data: weaknesses

Amendments to Study Design: The initial Phase 2 trial by BlackThorn was designed for mild to moderate MDD patients. Though the inclusion criteria were later adjusted to encompass moderate to severe MDD, this shift could indicate a potential recognition that the drug might not be as efficacious in a milder cohort. Such retrospective adjustments, while perhaps strategically sound, do introduce elements of post-hoc analysis, potentially confounding interpretation.

Endpoint Achievements: While Navacaprant did show statistical significance in various metrics, the primary endpoint for the original study design, which was the HAMD-17 score at Week 8, did not achieve statistical significance against placebo. The failure to meet the primary endpoint in the broader cohort, even if later the focus shifted, remains a cause for concern.

Historically, many Phase 3 trials in MDD suffer from a high placebo response, which can eclipse the therapeutic effects of the investigational drug. Navacaprant's Phase 2 results, while promising, were conducted on a relatively small scale. It's plausible that when expanded to a larger patient cohort in Phase 3, the placebo effect could become more pronounced, especially if patient expectations are raised by prior Phase 2 publicity.

Several drugs that showed promise in Phase 2 trials for MDD failed to demonstrate the same efficacy in Phase 3, due to the complex nature of the disorder, the heterogeneity of the patient population, and the challenges in maintaining consistent study conditions across a larger, more diverse patient cohort.

MDD's diagnosis relies heavily on subjective measures, which could lead to significant variability in patient responses. This subjective variability becomes even more pronounced in larger trials, and the absence of more objective, biomarker-driven endpoints could challenge the reproducibility of Navacaprant's Phase 2 successes in Phase 3.

Although the Phase 2 study showed Navacaprant as having a favorable safety profile over a short-term period, longer-term studies in Phase 3 could unveil latent adverse events or long-term risks, which are not uncommon with CNS-active agents.

Get more articles like this...

...by joining our mailing list. Check out our other articles to see if our content is a good fit for you.

MDD Market Dynamics

Major Depressive Disorder is not just a medical challenge but also represents a vast market opportunity. With MDD affecting an estimated 264 million people globally and over 21 million adults in the U.S., the addressable market for effective therapies is substantial. Furthermore, the evident gap in the current treatment paradigm – where many patients either remain untreated or do not achieve desired remission with first-line therapies – accentuates the potential market share Navacaprant could garner. Especially pertinent is the drug's focus on anhedonia, a symptom frequently sidelined by current treatments.

To evaluate the market opportunity for Navacaprant, we must consider several factors, including the prevalence of Major Depressive Disorder (MDD), the unmet medical needs in this space, the revenue achieved by other successful MDD drugs, and the pricing landscape. Let's explore each of these aspects in detail:

- Prevalence of MDD: The global prevalence of MDD is substantial, affecting approximately 264 million people. In the U.S. alone, over 21 million adults suffer from MDD. Given this high prevalence, even capturing a small market share can result in substantial revenue.

- Unmet Medical Needs: Many individuals diagnosed with MDD either don't receive treatment or don't achieve remission using first-line therapies like SSRIs or SNRIs. Moreover, the inadequacy of current treatments in addressing core symptoms like anhedonia presents a significant opportunity for drugs that can fill this therapeutic gap. Navacaprant's unique mechanism of action targeting the KOR/dynorphin system might allow it to address these unmet needs, giving it a competitive advantage.

- Revenue of Other Successful MDD Drugs: Several MDD drugs have been commercial successes:

- Prozac (fluoxetine): After its launch, Prozac rapidly became a blockbuster drug, with peak sales reaching over $2 billion annually in the late 1990s.

- Zoloft (sertraline): Another SSRI, it achieved peak annual sales of around $3 billion in the mid-2000s.

- Cymbalta (duloxetine): An SNRI, it had sales reaching approximately $5 billion annually before the loss of patent exclusivity.

- Brintellix (vortioxetine): Introduced more recently, it has witnessed growing sales, with annual revenue surpassing $1 billion.

- Pricing Landscape for MDD Drugs: The pricing of MDD drugs varies based on factors such as the drug's novelty, efficacy, safety profile, and competition. Brand-name antidepressants can be priced between $300 to $600 per month without insurance. However, as patents expire and generics become available, prices typically decrease significantly. If Navacaprant offers a distinct advantage over existing treatments, especially in safety and efficacy, it might command a premium price.

- Potential Patients for Navacaprant: Given that Navacaprant's Phase 3 program focuses on moderate to severe MDD patients, we can estimate its potential patient population by considering this subset. While exact numbers can vary, if we conservatively assume that 40% of the 21 million MDD patients in the U.S. fall under the moderate to severe category, the potential patient pool for Navacaprant in the U.S. alone would be around 8.4 million.

The market opportunity for Navacaprant appears robust. Given the vast prevalence of MDD, the unmet medical needs, and the success achieved by previous MDD drugs, Navacaprant, if successfully commercialized, might capture a significant market share. Its unique selling proposition could lie in its novel mechanism of action and potential efficacy in treating anhedonia. If it is priced competitively and demonstrates superior efficacy and safety profiles, it has the potential to achieve revenues comparable to, or even surpassing, other successful MDD drugs.

Navacaprant (NMRA-140): bipolar

Navacaprant, a selective KOR antagonist, presents a promising therapeutic option for bipolar disorder, an ailment characterized by drastic mood, energy, and activity level fluctuations.

Mechanism of Action and Rationale

Bipolar disorder, comprising various subtypes (Bipolar I, Bipolar II, and cyclothymic disorder), affects approximately 7 million adults in the U.S. Each subtype presents unique challenges in treatment, especially Bipolar II, which demonstrates significant unmet clinical need due to atypical symptoms and resistance to existing treatments.

Anhedonia, a prevalent and clinically pertinent symptom in both MDD and bipolar depression, has been highlighted as a cardinal feature of these disorders. It refers to the inability to feel pleasure and is notoriously difficult to treat effectively with existing medications.

Preclinical studies and the company's Phase 2 clinical trial have suggested that KOR antagonists, including Navacaprant, can effectively alleviate depression symptoms, particularly anhedonia. Given anhedonia’s prominent role in bipolar depression, Navacaprant's effectiveness in mitigating this symptom in MDD patients provides a logical and scientifically grounded rationale for its potential utility in treating bipolar depression as well.

Strengths of the Evidence Base

- Positive Results in Preclinical and Phase 2 Trials: Navacaprant has been shown to improve depression and anhedonia symptoms in both preclinical studies and the Phase 2 clinical trial conducted for MDD.

- Support from External Studies: The evidence base is further reinforced by external studies, including the NIMH’s FAST-MAS study, which demonstrates the effectiveness of KOR antagonists in improving depression symptoms.

- High Prevalence of Anhedonia in Target Population: With anhedonia being a significant and common symptom in bipolar depression, improvements in anhedonia symptoms suggest potential efficacy in this patient population.

Weaknesses of the Evidence Base

- Lack of Direct Clinical Evidence in Bipolar Population: While promising, the current evidence base primarily stems from studies focused on MDD, not bipolar disorder. The pathology and symptomatology of bipolar disorder are complex and distinct from MDD, so clinical efficacy in MDD does not guarantee similar outcomes in bipolar patients.

- Reliance on the Hypothesized Mechanism of Action: The rationale relies heavily on the assumed mechanism of action and the hypothesis that improvements in anhedonia will translate to overall clinical benefit for bipolar patients, which remains to be empirically validated in this specific patient population.

- Potential Variation in Response Across Patient Subgroups: Bipolar disorder is heterogeneous, with patients often responding differently to treatments due to genetic, environmental, and other biological factors. The current evidence base does not provide insights into how various subgroups within the bipolar population might respond to Navacaprant.

Navacaprant offers a compelling and scientifically grounded rationale for treatment in bipolar disorder, with a focus on addressing the significant and challenging symptom of anhedonia. While the existing evidence base provides a solid foundation for optimism, direct clinical evidence in bipolar patients is necessary to validate the hypothesized benefits, warranting carefully designed and rigorously conducted clinical trials in the bipolar population. The planned clinical trial in 2024 aiming to evaluate Navacaprant's safety and efficacy in bipolar patients will be crucial in providing this much-needed clinical validation.

Clinical development

The company plans to commence a clinical trial in the first half of 2024 to evaluate the safety and efficacy of navacaprant in patients with bipolar depression. This trial is expected to generate data that will further inform the development of navacaprant in bipolar depression.

Clinical development for bipolar disorder presents various challenges. Firstly, the disorder's substantial clinical heterogeneity complicates the selection of patient populations and measurable endpoints for trials. Secondly, the episodic nature of bipolar disorder, with patients oscillating between depressive and manic states, makes endpoint selection challenging. These endpoints must accurately reflect significant improvements in both depression and mania.

Moreover, high placebo response rates in bipolar disorder trials necessitate strategies to minimize this effect, like implementing placebo lead-in phases and applying strict inclusion and exclusion criteria. Patient recruitment and retention for these trials are also challenging due to the associated stigma, patient instability, and patients' hesitation to cease current treatments. Creative recruitment strategies and a carefully designed trial structure to lessen patient burden are essential.

Furthermore, since bipolar disorder treatment often involves patients taking multiple medications simultaneously, navacaprant’s safety profile must be meticulously evaluated concerning common concurrent medications, with potential drug interactions closely monitored.

Market

Approximately 7 million adults in the U.S. are affected by bipolar disorder, a serious psychiatric condition marked by recurrent depression and mania episodes. With many patients non-responsive to current treatments that often have limited efficacy and considerable side effects, there exists a significant market opportunity for new therapeutic agents like Navacaprant that can address these unmet needs. The drug's market share potential will be influenced by its pricing strategy; competitive pricing with existing branded antipsychotics, coupled with a strong efficacy and safety profile, can drive substantial revenue. For reference, branded drugs for bipolar disorder are typically expensive, with Abilify costing over $900 monthly without insurance, while generics like quetiapine range from $20 to $130 monthly.

NMRA-511

NMRA-511, a Vasopressin 1a Receptor (V1aR) antagonist, is designed to modulate behaviors such as aggression, stress, and anxiety, offering a new treatment approach for neuropsychiatric and neurodegenerative disorders. Vasopressin, which plays a role in regulating these behaviors, has been observed to increase in rodent brains in response to anxiety-inducing stimuli, with V1aR antagonists effectively reducing aggression and influencing related brain activity.

NMRA-511 not only shows significant selectivity for V1aR but also exhibits behavioral improvement in marmoset anxiety/agitation models and impacts brain activity, as evidenced by EEG data. Another V1aR antagonist, SRX246, demonstrated anxiety reduction in a small human study, bolstering the therapeutic rationale for NMRA-511.

Despite promising preclinical data, the transition from theoretical effectiveness to proven clinical efficacy is still uncertain due to NMRA-511’s early development stage and limited human efficacy data. The drug is currently in a Phase 1 Multiple Ascending Dose trial to assess its safety, tolerability, and pharmacokinetics. Clinical trials for patients with Alzheimer's Disease-related agitation are planned post-Phase 1 in the first half of 2024.

Strengths of the Evidence Base

- Selective Antagonism: NMRA-511 displays over 3000-fold selectivity for V1aR over other receptors, promising targeted pharmacological action with potentially fewer off-target effects.

- Positive Preclinical Data: NMRA-511 has demonstrated efficacy in reducing anxiety/agitation in animal models, with supportive changes in brain activity.

- Third-Party Human Data Support: Existing small-scale human data on another V1aR antagonist support the anxiolytic potential of this class of drugs.

Weaknesses of the Evidence Base

- Early Clinical Development Stage: Currently, NMRA-511 is in early clinical development (Phase 1), and human efficacy data for the compound are lacking.

- Limited Human Data: While Phase 1 trials have established the initial safety and tolerability of NMRA-511, there is no direct evidence yet of its efficacy in patients with neuropsychiatric disorders.

- Translation from Preclinical to Clinical: Preclinical findings, while promising, do not always translate into clinical efficacy. Further well-designed clinical trials are needed to establish NMRA-511's effectiveness in patient populations.

Platform and other preclinical programs

Before delving into Neumora’s preclinical programs, let's briefly note the company’s use of Precision Neuroscience. This approach aims to enhance patient outcomes by developing therapies tailored to the biological intricacies of brain diseases. Through their Precision Toolbox, Neumora utilizes specialized tools, proprietary algorithms, and an extensive data library, facilitating the identification of targeted patient populations and the optimization of clinical trials. This strategy is integral in matching patients with the most effective drug treatments.

NMRA-266

- Program Name: NMRA-266.

- Target: M4 muscarinic receptor (M4R).

- Indication: Schizophrenia (with potential for other neuropsychiatric disorders).

- Mechanism of Action: Positive allosteric modulator of M4R.

NMRA-266 is crafted to selectively modulate M4R, anticipated to provide antipsychotic efficacy with fewer side effects compared to existing therapies.

Current antipsychotics primarily antagonize D2 dopamine receptors, but M4R offers a novel approach. Evidence suggests that targeting M4R can yield antipsychotic effects.

Positive allosteric modulation of M4R is hypothesized to address both positive and negative symptoms of schizophrenia, potentially improving upon the limitations of existing treatments.

Supporting evidence

Clinical data indicates that M4 muscarinic receptor-targeting compounds have shown promise in treating schizophrenia.

A Phase 2 trial (Emergent-1) by Karuna Therapeutics displayed statistically significant improvements in PANSS scores, a primary measure of symptom severity in schizophrenia, using an M1/M4-preferring muscarinic agonist combined with a peripheral muscarinic antagonist.

Subsequent Phase 3 trials (Emergent-2 & Emergent-3) and a Phase 1b trial conducted by Cerevel Therapeutics with another M4 receptor positive allosteric modulator further supported these findings.

Preclinical and clinical evidence collectively underpin the importance of the muscarinic acetylcholine receptor system in managing psychoses, cognition, movement, learning, and memory.

Get more articles like this...

...by joining our mailing list. Check out our other articles to see if our content is a good fit for you.

Market potential

Approximately three million people in the United States suffer from schizophrenia. Existing treatments, primarily developed based on mechanisms discovered in the 1950s, primarily address positive symptoms, with limited impact on negative or cognitive symptoms. These also come with serious side effects.

NMRA-266 introduces a novel mechanism of action in a market where innovation has been stagnant, potentially offering a new therapeutic avenue for patients.

Development plan

NMRA-266 is currently in preclinical development. Multiple series of M4R-positive allosteric modulators, including the lead molecule, have demonstrated promising activity and selectivity in preclinical efficacy models. IND (Investigational New Drug) submission to the FDA is anticipated in the fourth quarter of 2023.

The molecules within the M4R program are in various preclinical development stages, ranging from pre-candidate selection to the completion of IND-enabling studies.

Summary

NMRA-266 presents a promising approach to schizophrenia treatment by selectively modulating the M4 muscarinic receptor. Supported by robust clinical and preclinical evidence, it aims to address the significant unmet needs in schizophrenia therapy by potentially providing an effective treatment that minimally impacts negative and cognitive symptoms with a favorable safety profile. With an IND submission expected in late 2023, the development of NMRA-266 is eagerly anticipated in the field of neuropsychiatric drug discovery.

NMRA-NMDA

- Program Name: NMRA-NMDA.

- Target: NMDA (N-Methyl-D-Aspartate) receptors, specifically GRIN2A/GluN2A-containing NMDA glutamate receptors.

- Indication: Schizophrenia.

- Mechanism of Action: Positive allosteric modulator of NMDA receptors.

NMRA-NMDA is designed as a positive allosteric modulator targeting a distinct binding site on NMDA receptors. This approach is based on recent genetic evidence supporting the role of NMDA receptors in schizophrenia.

NMRA-NMDA enhances the activity of GRIN2A/GluN2A-containing NMDA receptors, crucial components in the brain’s glutamate neurotransmission system. Dysregulation of glutamate levels and NMDA receptor function has been hypothesized as a key molecular driver of schizophrenia.

Large studies have identified the GRIN2A gene (encoding the GluN2A subunit of the NMDA receptor) as a significant genetic risk factor for schizophrenia. Human pharmacology experiments indicate that decreased NMDA receptor activity may induce schizophrenia-like symptoms, suggesting that compounds elevating NMDA receptor activity, like NMRA-NMDA, could be potential treatments.

Supporting evidence

Genetic studies have implicated the GRIN2A gene and, by extension, GluN2A-containing NMDA receptors, in the pathology of schizophrenia.

NMDA receptor antagonists like ketamine have been observed to induce schizophrenia-like syndromes in individuals, reinforcing the receptor’s involvement in the disorder.

The program has identified investigational positive allosteric modulators potent and orally bioavailable through cell-based assays. These molecules also demonstrated target engagement and pharmacodynamic activity in relevant animal models.

Market potential

NMRA-NMDA is being developed for schizophrenia, a debilitating disorder affecting millions worldwide. Existing schizophrenia treatments have various limitations, including side effects and lack of efficacy for all symptom clusters (positive, negative, and cognitive symptoms). With a mechanism of action based on recent genetic findings, NMRA-NMDA represents a novel approach in a treatment landscape that needs innovative solutions.

Development plan

NMRA-NMDA is currently in the preclinical stage of development.

The program was internally discovered, focusing on proprietary chemistry targeting distinct binding sites on NMDA receptors. Lead molecules have been identified and characterized regarding their potency, selectivity, and mechanism of action through cell-based assays and animal models.

Summary

NMRA-NMDA, as a positive allosteric modulator of NMDA receptors, offers a novel approach to treating schizophrenia based on recent genetic and pharmacological findings. With the preclinical program demonstrating promising results in terms of potency and target engagement, NMRA-NMDA is an exciting candidate in the quest for innovative schizophrenia treatments. The program is currently in the preclinical stage, with further development and clinical trials anticipated in the future.

NMRA-CK1delta

- Program Name: NMRA-CK1delta (NMRA-CK1d).

- Target: Casein kinase 1 delta (CK1d).

- Indication: Amyotrophic Lateral Sclerosis (ALS).

- Mechanism of Action: Inhibitor of CK1d.

CK1d is recognized as a key regulator of TDP-43 phosphorylation, which is crucial in the pathology observed in about 95% of sporadic ALS cases. There's genetic evidence backing the involvement of TDP-43 in ALS, making CK1d a compelling target for intervention.

NMRA-CK1d aims to inhibit CK1d, a kinase involved in the phosphorylation of TDP-43, thereby potentially mitigating TDP-43-driven pathology in ALS. The inhibition of CK1d is hypothesized to reduce TDP-43 phosphorylation and, as a result, alleviate the pathological progression associated with TDP-43 in ALS patients. Supporting this hypothesis, CK1d inhibitors have been shown to reverse TDP-43 related phenotypes in both in vitro and in vivo studies as per published data.

Supporting evidence

The inhibitors under the NMRA-CK1d program exhibit nanomolar potency, demonstrate selectivity over other kinases, and show cell-based activity. These compounds also possess properties conducive to central nervous system (CNS) penetration, a crucial factor for their effectiveness in ALS.

Through the application of data science algorithms to ALS patient data, preliminary analysis suggests that there may be identifiable sub-groups of ALS patients more responsive to NMRA-CK1d, aiding in the design of future clinical studies.

Market potential

ALS is a severe neurodegenerative disease, with around 5,000 new diagnoses in the U.S. annually. Currently, around 16,000 individuals live with ALS in the U.S.

Present treatments offer only modest improvements in survival and physical function, with no significant impact on mortality. Given the average life expectancy of two to five years post-diagnosis, there is a significant unmet medical need for effective ALS treatments.

Development plan

NMRA-CK1d is in the preclinical development stage. During this phase, the program is conducting experiments in vitro and in vivo relevant to ALS. Additionally, data analysis is underway to identify potential responder and non-responder populations among ALS patients for future clinical studies.

Intellectual property rights related to NMRA-CK1d have been exclusively licensed from Amgen, providing a secure basis for the program's development.

Summary

NMRA-CK1delta offers a promising approach to ALS treatment by targeting CK1d, a kinase implicated in the phosphorylation of TDP-43, a protein crucial to ALS pathology. With preclinical data showing promise and a significant unmet medical need in the ALS patient population, NMRA-CK1delta represents a valuable addition to the field of ALS drug development. The program is presently in the preclinical phase, with ongoing experiments and data analysis to support its advancement to clinical trials.

NMRA-NLRP3

- Program Name: NMRA-NLRP3.

- Target: NLRP3 inflammasome.

- Indication: Targeted for treatment in neurodegenerative conditions, with a specific focus on Parkinson’s Disease (PD).

- Mechanism of Action: Inhibitor of the NLRP3 inflammasome.Mechanism of Action: Inhibitor of the NLRP3 inflammasome.

The NLRP3 inflammasome, part of the innate immune system, is known to activate in response to cellular damage and pathogens. Activation occurs in brain microglia and other cells due to proteins linked with neurodegeneration, such as alpha-synuclein, indicating a potential mechanistic role in PD.

NMRA-NLRP3 seeks to inhibit the NLRP3 inflammasome, which is chronically activated in various neurodegenerative and inflammatory diseases, potentially mitigating inflammatory responses related to PD.

Since proteins like alpha-synuclein (associated with PD and other synucleinopathies), TDP-43 (linked to ALS, FTD, etc.), beta-amyloid, and tau (both linked to Alzheimer’s Disease) activate the NLRP3 inflammasome, inhibiting this inflammasome might offer therapeutic benefits in these conditions. Recent studies in PD models support the therapeutic potential of NLRP3 inflammasome inhibition.

Supporting evidence

NMRA-NLRP3 program has identified various NLRP3 inhibitors showcasing potency and selectivity in cellular assays conducted with different cell lines and primary immune cells, including microglia. These inhibitors have demonstrated both target engagement and pharmacodynamic activity in animal models relevant to the mechanism.

Market potential

PD affects approximately one million people in the U.S., characterized by the progressive loss of dopamine-producing neurons, leading to motor function impairment.

While current PD therapeutics aim to elevate dopamine levels to manage symptoms, they have notable efficacy limitations and side effects. Thus, there's a significant unmet need for novel and effective treatments.

Development plan

NMRA-NLRP3 is in the preclinical development phase. During this phase, the program is identifying and testing NLRP3 inhibitors, analyzing their potency, selectivity, and activity in various cellular assays and animal models.

The program is also conducting experiments to analyze multi-modal patient data for PD, using proprietary data science algorithms to identify potential sub-groups of PD patients who might respond more favorably to NMRA-NLRP3 treatment.

Summary

NMRA-NLRP3 presents a novel approach in neurodegenerative treatment by targeting the NLRP3 inflammasome implicated in various neurodegenerative diseases, including PD. With promising preclinical data and a significant unmet medical need for improved PD treatments, NMRA-NLRP3 offers a potential new path in the field of neurodegenerative disease drug development. Currently, the program is in the preclinical stage, working on identifying and validating effective NLRP3 inhibitors and analyzing patient data to inform future clinical studies.

NMRA-GCase

- Program Name: NMRA-GCase.

- Target: Glucocerebrosidase (GCase) enzyme.

- Indication: Parkinson’s Disease (PD).

- Mechanism of Action: The program focuses on developing activators to elevate the activity of the GCase enzyme.

Mutations in the GBA1 gene, coding for the GCase enzyme, represent the largest genetic risk factor for PD. Deficiencies in GCase lead to lysosomal storage disorders, with a subset of PD patients exhibiting lysosomal dysfunction.

The program aims to activate both wild type and mutant forms of GCase, an enzyme crucial for recycling and disposing of proteins and lipids in lysosomes. Mutations in the GBA1 gene are found in approximately 10% of PD patients, leading to a decrease in GCase function, lysosomal dysfunction, cell toxicity, inflammation, and accumulation of alpha-synuclein (neurotoxic and a PD hallmark). Activating GCase may potentially alleviate these effects, offering therapeutic benefits to PD patients.

Supporting evidence

The program has identified multiple small molecule series that can activate both wild type and mutant GCase enzymes with similar potency through high-throughput screening. Biophysical data suggest that these molecules bind directly to the target.

Market potential

PD is a significant neurodegenerative disorder affecting around one million people in the U.S., characterized by the progressive loss of dopamine-producing neurons and subsequent motor function impairments.

Given the prevalence of PD and the limitations of current treatments, there is a significant need for novel therapies addressing the genetic risk factors and underlying mechanisms of the disease.

Development plan

NMRA-GCase is in the preclinical development phase, where it is focused on identifying and developing GCase activators that can directly bind and activate both wild type and mutant forms of the enzyme.

The program has exclusively licensed certain intellectual property rights related to NMRA-GCase from Amgen.

Summary

NMRA-GCase is a promising preclinical program aiming to develop therapies for PD by targeting the GCase enzyme, which is crucial in cellular balance and is implicated in PD due to mutations in the GBA1 gene. With a focus on activating both wild type and mutant GCase directly, the program is addressing significant unmet needs in the PD patient population, providing a novel approach to PD treatment. The program is currently in the preclinical stage, working on the development and validation of GCase activators.

Management Overview

Neumora Therapeutics boasts a management team that seamlessly merges industry acumen with scientific expertise.

At the core of the leadership, Paul L. Berns, with his vast experience in drug development, most notably leading Anacor Pharmaceuticals until its acquisition by Pfizer, has demonstrated a proven capacity to navigate the biopharmaceutical landscape. Henry O. Gosebruch, the firm's President and CEO, complements this with a unique blend of strategic insight from his tenure at AbbVie and M&A acumen garnered from J.P. Morgan. Carol Suh, having co-founded several biotechnology companies, and Dr. Joshua Pinto, blending financial knowledge with neuroscience proficiency, further round off this competent executive suite.

The scientific front is helmed by industry veterans. Dr. Bill Aurora's diverse roles at organizations like Dermira and Merck, Dr. Michael Gold's noteworthy contributions to CNS therapies at AbbVie, and Dr. Nick Brandon's strategic direction from experiences at AstraZeneca and Pfizer, collectively fortify Neumora's research and development endeavors.

Supported by a board of directors with a wide-ranging industry background and an investor group that has shown substantial confidence through significant funding, Neumora Therapeutics stands on a solid foundation to confront the challenges and opportunities in the neuroscience drug development sector.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.

Detailed model overview

Navacaprant

- Market Landscape

- MDD has a range of both branded and generic products available.

- Brand-name antidepressants are priced between $300 to $600 per month without insurance.

- Drugs with novel mechanisms, strong efficacy, and distinct safety advantages might command premium pricing.

- Navacaprant Pricing Estimate

- Navacaprant is expected to be priced at the higher end due to its unique mechanism and potential efficacy.

- Estimated price range: $8,640 to $9,360 per patient per year, considering a premium of 20-30% over current high-end branded antidepressants.

- Pricing Considerations and Adjustments

- Pricing will depend on insurance coverage, reimbursement dynamics, and offered discounts and rebates.

- Patient Assistance Programs (PAPs), affecting net realized price, should be factored into the model.

- Pricing can be influenced by market penetration, adoption rates, initial usage as a second/third-line therapy, and competitive landscape.

- Expect variations in pricing across different countries due to regulatory, economic, and healthcare system differences.

- Price Adjustment Calculation for Attrition Factors

- Non-adherence: Estimated at 50%, based on WHO data for chronic diseases, significantly impacting yearly revenue per patient.

- Recovery: With 30-40% remission rates, assume 35% of patients won't contribute to full annual revenue due to recovery.

- Ineffectiveness: 20% of patients might not respond effectively, contributing only partially to yearly revenue.

- Adjusted price considering attrition: Estimated expected revenue per patient per year is $2,433.60.

- MDD Market Share and Revenue Modeling

- Positioning: Navacaprant could be a first-line, adjunct, or later-line therapy depending on Phase 3 results and differentiation factors.

- Competition: Market includes many generics, typically priced lower and often used as first-line treatments.

- Adoption Barriers: Factors include physician familiarity, insurance dynamics, post-launch safety issues, and patient willingness to switch.

- Price Sensitivity: Navacaprant's price will influence adoption, considering market tolerance, payer negotiations, and competitive positioning.

- Adoption and Revenue Estimates:

- Early Adoption (Years 1-2): Estimated 1-2% market capture, translating to 84,000 to 168,000 patients and $204M to $409M in revenue.

- Peak Adoption (Years 5-7): Optimistic estimation of 10% market capture, with 840,000 patients and $2.04B in revenue, assuming positive drug reception and proven effectiveness.

- Market Dynamics for Bipolar Disorder

- Complex treatment landscape with various first-line and adjunctive therapies, both branded and generic.

- Navacaprant needs to significantly distinguish itself in efficacy, safety, and tolerability to gain considerable market share.

- Potential Market Positioning of Navacaprant

- Possibility of being positioned as either a later-line therapy or a therapy for a specific subset of bipolar patients, influencing its initial market share.

- Initial market share is expected to be modest but has the potential to grow with positive real-world evidence and broader adoption.

- Market Share Estimates

- Initial market share is projected to be between 1-2%, with potential growth to 5-8% at peak depending on reception and supporting data.

NMRA-511

- Comparable Drugs Pricing

- Existing treatments for Alzheimer’s-related agitation range from $300 to $1,000 per month.

- NMRA-511 may command a premium price due to presumed efficacy and safety advantages over atypical antipsychotics.

- Pricing Estimation for NMRA-511

- Estimated premium price: approximately $1,800 per month or higher.

- After accounting for patient attrition factors, effective monthly price per patient is approximately $1,061.44, resulting in an effective annual price per patient of around $12,737.28.

- Patient Attrition Factors

- Non-adherence: 20-30%.

- Symptom resolution: 5-10%.

- Drug ineffectiveness: 10-20%.

- Duration of Therapy

- Alzheimer’s patients might use NMRA-511 for an average of 6 to 12 months due to the chronic nature of the disease and patient attrition factors.

- Market Size and Share

- U.S. Alzheimer’s patient population: approximately 6.7 million.

- About 76% experience agitation, equating to a target market of approx. 5.1 million patients.

- Expected initial market share: 1-3% post-launch, with a peak market share of 10-20% depending on various factors.

Licenses and agreements

Summary of Agreement Between Neumora and Amgen

The agreement encompasses exclusive licensing for CK1d and GCase, a collaborative research initiative for CNS diseases, and equity transactions between Neumora and Amgen. The partnerships involve various financial commitments, responsibilities, and obligations for both parties, aiming to foster the development and commercialization of therapeutic products in the specified areas, with defined terms for ownership, licensing, and termination.

Exclusive License Agreements for CK1d and GCase (September 2021):

Neumora received a global, exclusive license from Amgen to develop, manufacture, and commercialize products targeting CK1d and GCase. Neumora is responsible for the complete development and commercialization process of the licensed products. Neumora is required to put in reasonable efforts to develop, get approval, and commercialize at least one licensed product under each agreement. Neumora cannot develop or commercialize other products targeting CK1d or GCase unless they are treated as licensed products under the Amgen agreements or the program is divested or terminated.

Neumora agreed to pay Amgen up to $360 million per licensed product for both CK1d and GCase upon reaching sales milestones. Royalties on sales of licensed products are also due, with percentages varying depending on the product and agreement terms.

Research Collaboration Agreement with Amgen (September 2021):

The agreement is a five-year collaboration to discover drug targets, biomarkers, and insights related to CNS diseases, utilizing Amgen’s deCODE genetics and human data research capabilities.

Neumora will make non-refundable payments to Amgen totaling between $62.5 million and $75 million over the first three years.

Equity Issuance and Additional Financing:

Neumora issued 157 million shares of Series A-2 Preferred Stock to Amgen and sold an additional 100 million shares at $1.00 per share, raising $100 million. Amgen may provide additional financing up to $100 million, subject to certain conditions, terminating upon the completion of a specified offering.

Summary of 2015 TSRI License Agreement

The 2015 TSRI (The Scripps Research Institute) License Agreement, transferred to Neumora through its acquisition of BlackThorn, provides exclusive and non-exclusive licenses to Neumora for the development of products under TSRI’s KOR, V1aR, and OTR programs. Neumora has specific obligations and financial commitments, including milestone payments and royalties.

Regarding patent details, the final patent in the agreement is set to expire in 2038. While Neumora holds these licenses, TSRI retains rights for internal research and educational purposes. Furthermore, TSRI can grant non-exclusive licenses to non-profits and academic institutions for similar use.

Neumora is obliged to meet specific research, development, and regulatory milestones as part of this agreement. The company has committed to using "commercially reasonable efforts" to secure regulatory approvals and to commercialize the licensed products.

In terms of financial arrangements, TSRI received 1% of BlackThorn’s fully diluted capital stock. Additionally, Neumora compensated TSRI with a "change of control success fee" valued at $0.3 million in Series A-1 convertible preferred stock. Neumora is also responsible for paying TSRI an annual nominal license fee, which will be credited against any royalties due for that year. The agreement outlines milestone payments up to $1.5 million for development and regulatory milestones and up to $3.5 million for commercial milestones for each program. Furthermore, revenues from sublicensing will be shared with TSRI, with rates ranging from mid-single digits to sub-teen double digits. Lastly, Neumora is set to pay royalties to TSRI based on worldwide net sales of products, calculated on a product-by-product and country-by-country basis, all subject to specific conditions and reductions.

Summary of Vanderbilt License Agreement

Neumora has secured a licensing agreement with Vanderbilt University, obtaining an exclusive global license for certain patents and a non-exclusive license for specific know-how related to small molecule positive allosteric modulators (PAMs) of the M4 receptor subtype. This agreement facilitates the development, manufacture, and commercialization of related products, with an option for Neumora to acquire additional licenses for patents developed under a sponsored research agreement.

The agreement lasts until the final patent expires in 2041, with Vanderbilt retaining rights for research and educational uses. Neumora is committed to diligently developing and commercializing the licensed products, with a significant development milestone due by June 2024.

The financial terms include a $13.0 million upfront fee paid by Neumora, tiered royalties on net sales, a percentage of sublicense income, and milestone payments up to $422.4 million. As of June 30, 2023, no payments beyond the upfront fee have been made.

Summary of Harvard License Agreement

Through acquiring Syllable, Neumora secured an exclusive, global license from Harvard University, gaining rights to certain patents and copyrights related to behavioral imaging and tracking software. This license facilitated the development and commercialization of products and services based on these technologies.

Upon acquisition, Neumora assumed Syllable's financial obligations, including a change of control payment and nominal annual license maintenance fees. These fees could be credited against the royalties due from the sales of products developed under the license within the same year. Furthermore, Neumora agreed to pay mid-single digit royalties on the net sales of each product developed under the license and a percentage of revenues from sublicensing, ranging from high teens to low double digits. Royalties were to be paid on a product-by-product and country-by-country basis until either the expiration of the relevant patents or the fifteenth anniversary of the first commercial sale of each product, whichever occurred later.

A March 2021 amendment extended the timeline for Neumora to meet specified development and commercial milestones set for December 2021 to January 2024. Failure to meet these milestones would be deemed a material breach of the agreement, giving Harvard the right to terminate the contract after a notification and cure period. However, the agreement was mutually terminated on March 31, 2023, with Neumora not having achieved any of the established development or sales-based milestones by the time of termination.

Summary of acquisitions

In September 2020, Neumora acquired BlackThorn Therapeutics, Inc., primarily for its Intellectual Property & Research and Development (IPR&D) assets related to neurobehavioral disorders. The acquisition encompassed two clinical-stage programs (NMRA-140 and NMRA-511) and a data platform that supports drug target identification and clinical trials. Neumora issued Series A-1 convertible preferred stock and warrants valued at $36.6 million, paid $0.1 million in cash, and assumed and settled $11.0 million of BlackThorn’s debt, incurring transaction costs of $1.6 million in the process. BlackThorn's former stockholders are entitled to milestone payments of up to $365 million for navacaprant and up to $200 million for NMRA-511, payable in cash or equity, although no milestones had been achieved as of June 30, 2023.

In the same month, Neumora also acquired Syllable Life Sciences, Inc., securing proprietary rights and IPR&D of a behavior analysis tool that employs machine learning and computer vision to diagnose neurological conditions. The consideration for this acquisition was Series A-2 convertible preferred stock valued at $4.9 million, with transaction costs amounting to $0.4 million. Syllable's former stockholders may receive up to $5.0 million in future milestone payments, payable in cash or equity upon the achievement of specific development milestones.

Furthermore, in November 2020, Neumora acquired Alairion, Inc. for its group of IPR&D assets, which included two preclinical programs and a drug discovery technology platform concentrating on sleep disorders. Neumora settled Alairion’s senior secured promissory note of $1.8 million and incurred transaction costs of $0.3 million. Contingent milestone payments of up to $33.5 million for development events and $135 million for commercialization events, payable in cash or equity, were arranged, though no milestones were achieved as of June 30, 2023. Notably, development of the NMRA-094 product, acquired from Alairion, was halted due to feedback from the FDA.

In summary, Neumora strategically acquired BlackThorn Therapeutics, Syllable Life Sciences, and Alairion primarily for their valuable IPR&D assets in neurobehavioral and sleep disorders. The acquisitions were financed through a combination of stocks, cash, assumption of debt, and commitments for future contingent milestone payments, with no milestones reached by June 30, 2023. Each acquisition also generated additional transaction costs.

The easiest way to build DCF models

Build robust biotech valuation models in the browser. Then download a fully built excel model, customized with your inputs.