Viking Phase 2 results

March 1, 2024

This is not investment advice. We used AI and automated software tools for most of this research. A human formatted the charts based on data / analysis from the software, prompted the AI to do some editing, and did some light manual editing. We did some fact checking but cannot guarantee the accuracy of everything in the article. We do not have a position in or a relationship with the company.

Update Mar 7, 2024: Novo oral GLP-1 data

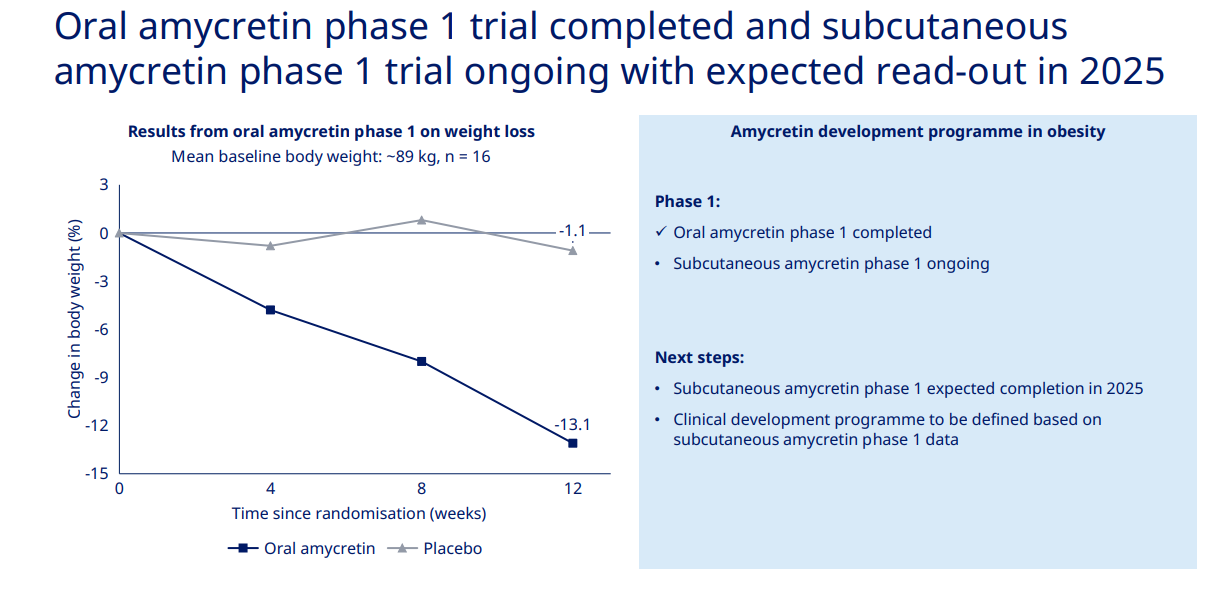

The above image is from Novo's 2024 Capital Markets day and was manually added by a human. The rest of this article is AI generated

The text extracted from the image presents information about a phase 1 trial for an obesity treatment called oral amycretin. Here are the key points from the text:

- The oral amycretin phase 1 trial has been completed.

- There is an ongoing subcutaneous amycretin phase 1 trial, with expected results in 2025.

- The results shown are from the oral amycretin phase 1 trial on weight loss.

- The mean baseline body weight of participants was approximately 89 kg, with a sample size of 16 participants.

- Next steps include the expected completion of the subcutaneous amycretin phase 1 in 2025 and the subsequent definition of a clinical development program based on the phase 1 data of subcutaneous amycretin.

The chart summarizes the change in body weight percentage over time since randomisation in weeks. It compares the effects of oral amycretin and a placebo over a 12-week period. The key points from the chart are:

- Oral amycretin shows a significant reduction in body weight percentage over time, with a marked decrease by week 12 (approximately a 13.1% reduction from the baseline).

- The placebo group shows a relatively stable body weight percentage with a slight decrease (about a 1.1% reduction from the baseline by week 12).

- The chart visually indicates that oral amycretin may have a substantial impact on weight loss in comparison to the placebo.

Here is the updated table with the information on oral amycretin included:

| Name | Name of Notable Phase 3 Studies | % Reduction in Body Weight (Placebo-Adjusted) | % Reduction in Body Weight at Closest to 13 Weeks | Time Point | Notable Adverse Events | Route of administration |

|---|---|---|---|---|---|---|

| VK2735 (Viking Therapeutics) | Not specified | Up to 13.1% | Up to 13.1% | 13 weeks | Mostly mild or moderate GI-specific TEAEs | Subcutaneous |

| Orlistat (Xenical, Alli) | XENDOS | 5.8% to 10.2% | Not available at 13 weeks | 1-4 years | Gastrointestinal issues, nutrient malabsorption | Oral |

| Phentermine/Topiramate ER (Qsymia) | CONQUER, SEQUEL | Up to 9.8% | Not available at 13 weeks | 56 weeks | Mood changes, insomnia, increased heart rate | Oral |

| Naltrexone/Bupropion (Contrave) | COR-I, COR-II, COR-BMOD, COR-Diabetes | 5% to 9% | Not available at 13 weeks | 56 weeks | Nausea, constipation, headache, increased blood pressure | Subcutaneous |

| Liraglutide (Saxenda) | SCALE | Up to 8% | Not available at 13 weeks | 56 weeks | Gastrointestinal side effects, rare risk of thyroid C-cell tumors | Subcutaneous |

| Semaglutide (Wegovy) | STEP series | Up to 17.4% | Approx. 6% at 16 weeks | 68 weeks | Gastrointestinal issues, risk of thyroid tumors | Subcutaneous |

| Tirzepatide (Zepbound™) | SURMOUNT-1, SURMOUNT-2 | Up to 20.9% | 5 mg: Approx. -6%, 10 mg: Approx. -8%, 15 mg: Approx. -9% | 12 weeks (approx.) | Gastrointestinal adverse reactions, sometimes severe; thyroid C-cell tumors warning | Subcutaneous |

| Oral Amycretin (Trial Phase 1) | Not applicable | 13.1% (approx. 12% placebo-adjusted) | Approx. -13.1% at 12 weeks | 12 weeks | Not specified | Oral |

Implications for Viking

Comparing oral amycretin's Phase 1 results with VK2735's Phase 2 data requires consideration of various factors such as the stage of clinical development, efficacy, safety profile, administration route, and the potential for patient adherence.

- Stage of Clinical Development:

- VK2735 is further along in clinical development, having completed Phase 2 trials, which typically involve more participants and provide more robust efficacy and safety data. This advanced stage increases the likelihood of VK2735 entering the market sooner, assuming Phase 3 trials are successful.

- Oral amycretin is still in early clinical development, having only completed a Phase 1 trial. While the results are promising, the drug still needs to undergo Phase 2 and 3 trials to further assess its efficacy and safety.

- Patient Population:

- The Phase 2 VENTURE trial for VK2735 involved a larger and more diverse patient population, with 176 adults who are obese (BMI ≥30 kg/m^2) or overweight with comorbidities (BMI ≥27 kg/m^2). This allows for assessment in a population that is representative of the intended treatment group in clinical practice.

- In contrast, the oral amycretin Phase 1 trial had a much smaller sample size (16 participants) and did not specify patient characteristics such as BMI or the presence of weight-related comorbid conditions. Phase 1 trials typically focus on safety and tolerability in healthy volunteers or a small subset of target patients.

- Efficacy:

- VK2735 has shown a 13.1% placebo-adjusted mean weight loss at 13 weeks in its Phase 2 trial, indicating strong short-term efficacy for obesity treatment.

- Oral amycretin has demonstrated a similar magnitude of weight reduction (approximately 13.1% from baseline) by week 12 in its Phase 1 trial. However, these findings are preliminary.

- Safety Profile:

- The safety profile of VK2735 appears favorable, with mostly mild or moderate gastrointestinal-specific TEAEs reported.

- The safety profile of oral amycretin has not been detailed, which is a critical aspect of a drug's overall evaluation.

- Route of Administration:

- VK2735's administration route is likely subcutaneous, based on similar drugs in its class.

- Oral amycretin, as the name suggests, is administered orally, which could give it an edge in terms of patient adherence and preference.

- Fit into the Standard of Care:

- VK2735 could be positioned alongside other injectable therapies like semaglutide and tirzepatide if it demonstrates sustained efficacy and safety in Phase 3 trials.

- Oral amycretin could potentially disrupt the market by offering an effective oral alternative to injectable therapies, if it continues to demonstrate strong efficacy and a favorable safety profile.

- First-Line Therapy:

- VK2735 might be considered for first-line therapy if it demonstrates long-term efficacy and safety comparable to or better than current treatments.

- Oral amycretin has the potential to become a first-line therapy due to the preferred oral route and promising initial efficacy data, pending the results of further clinical trials.

- Commercial Potential:

- VK2735 has significant commercial potential, particularly if it reaches the market ahead of oral amycretin and establishes a strong safety and efficacy profile.

- Oral amycretin also has substantial commercial potential, especially given the preference many patients have for oral medications over injections. The success of the ongoing subcutaneous trial will likely inform the future development of the oral form.

In conclusion, both VK2735 and oral amycretin show promise in treating obesity. VK2735 is currently ahead in development and could become a part of the standard of care soon if Phase 3 trials are successful. Oral amycretin, while earlier in its development, shows potential due to its administration route and preliminary efficacy. The final position in treatment algorithms and their commercial success will heavily depend on further clinical data, especially regarding long-term outcomes and safety profiles.

Strategic value

Analyzing Viking Therapeutics as an acquisition target involves assessing its strategic value under different scenarios regarding its lead obesity treatment, VK2735. These scenarios will consider VK2735's competitive positioning in terms of efficacy, market entry timing, and its differentiation from existing and potential future treatments. Let's break down the strategic value in three distinct scenarios:

- Scenario 1: VK2735 Has Best-in-Class Weight Loss Efficacy

- Strategic Value: Viking Therapeutics would be a highly attractive acquisition target due to VK2735's market-leading efficacy. Being best-in-class would position Viking for a premium market share, command higher pricing, and attract strong interest from big pharma companies looking to dominate or expand their presence in the obesity market.

- Commercial Implications: Viking would benefit from rapid market penetration, potential for premium pricing, and strong partnerships for global distribution. The acquisition could offer the acquiring company a competitive edge in the metabolic disorders segment.

- Rough Probability: Given the promising but early data from Phase 2, let's conservatively estimate a 30% probability. This reflects optimism tempered by the need for successful Phase 3 outcomes and favorable comparison with emerging treatments like amycretin.

- Scenario 2: Best-in-Class When Approved but Disrupted by Amycretin

- Strategic Value: If VK2735 is best-in-class at approval but later disrupted by oral amycretin with superior data, Viking's value would depend on the timeframe between VK2735's launch and amycretin's market entry. Early success could still justify acquisition for the immediate competitive advantage and patient base capture.

- Commercial Implications: The initial market leadership could be leveraged for quick ROI before amycretin enters the market. Strategies could include rapid market penetration and building brand loyalty. The value might decrease once amycretin is available, depending on its market impact.

- Rough Probability: Considering drug development and approval timelines, assign a 40% probability. This reflects the competitive nature of the pharmaceutical industry and the commonality of rapid innovations.

- Scenario 3: Approved but Not Differentiated from Other SQ GLP-1 Agonists

- Strategic Value: If VK2735 shows similar efficacy and safety profiles to existing subcutaneous (SQ) GLP-1 agonists, its acquisition value would be based on filling a portfolio gap or enhancing the acquiring company's market share rather than pioneering a new treatment paradigm.

- Commercial Implications: Viking would still hold value through competitive positioning, market expansion capabilities, and potentially better cost-efficiency or patient adherence solutions. The acquisition could offer synergies for companies with existing metabolic disorder portfolios.

- Rough Probability: Given the crowded space of GLP-1 agonists and the incremental nature of pharmaceutical advancements, estimate a 30% probability. This acknowledges the challenge of significantly outperforming existing treatments.

Viking Phase 2 results

Viking Therapeutics announced the positive top-line results from its Phase 2 VENTURE trial evaluating VK2735, a dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors, for the treatment of obesity. Here's a summary of the study and its findings:

- Study Design and Objectives

- Trial Name: Phase 2 VENTURE trial

- Compound: VK2735, a dual GLP-1/GIP receptor agonist

- Objective: To evaluate the efficacy and safety of VK2735 in patients with obesity

- Duration: 13 weeks of treatment

- Key Findings

- Efficacy: The study achieved its primary endpoint and all secondary endpoints. Patients treated with VK2735 showed statistically significant reductions in body weight compared to those receiving a placebo. The maximum observed placebo-adjusted mean weight loss was 13.1%, with a 14.7% reduction from baseline, and no plateau in weight loss was observed over the 13-week period.

- Safety: VK2735 was reported to be safe and well-tolerated. 95% of gastrointestinal (GI)-specific treatment-emergent adverse events (TEAEs) were considered mild or moderate.

- Next Steps

Following these positive results, Viking Therapeutics plans to meet with the FDA to discuss the future development steps for VK2735.

Implications and Context

These results are significant as they demonstrate a potentially effective treatment option for obesity, a major global health issue. The dual agonist approach, targeting both GLP-1 and GIP receptors, could offer advantages over existing therapies by providing more substantial weight loss without reaching a plateau early in treatment. The safety profile, especially the predominance of mild or moderate GI-specific TEAEs, is also encouraging, as it suggests the treatment may be well-tolerated by a broad patient population.

Given the ongoing burden of obesity and its associated comorbidities, such as type 2 diabetes and cardiovascular diseases, the development of VK2735 could represent a significant advancement in obesity treatment, pending further validation in subsequent trials. The next steps will likely involve Phase 3 trials to confirm these findings in a larger population and over a longer period, which will be critical for assessing the long-term efficacy and safety profile of VK2735.

The market potential for VK2735, developed by Viking Therapeutics for the treatment of obesity, can be assessed by analyzing several critical factors:

- Short-term Efficacy: VK2735 showed up to 13.1% reduction in body weight at 13 weeks, which is promising when compared to other drugs at similar early time points. However, it's essential to note that this is a placebo-adjusted figure, and the average unadjusted weight loss is not specified. For a more accurate market potential assessment, both figures would be needed.

- Adverse Events Profile: VK2735 appears to have a tolerable adverse events profile, with most gastrointestinal-specific treatment-emergent adverse events (TEAEs) considered mild or moderate. This favorable safety profile, if maintained in longer trials, could be a strong market differentiator.

- Comparison with Existing Treatments: The table shows several established drugs with varying degrees of efficacy. Notably, Wegovy (semaglutide) and Zepbound (tirzepatide) show higher efficacy with up to 17.4% and 20.9% weight reduction respectively, although these figures are at a much later time point (68 and 72 weeks). If VK2735 can demonstrate sustained or improved efficacy over a similar or longer duration, it could become a competitive option in the market.

- Market Need: Obesity is a chronic condition with significant health implications and associated healthcare costs. There is a continuous need for new therapies, especially those that can offer better efficacy, safety, and patient adherence.

- Regulatory Path and Reimbursement: VK2735's eventual market potential will also depend on successful Phase 3 trials, FDA approval, and reimbursement policies. Favorable reimbursement coverage would significantly enhance its market potential.

- Pricing Strategy: The cost of VK2735 will play a crucial role in its market adoption. If competitively priced against existing therapies, especially if it offers similar or better outcomes, it could capture a significant market share.

- Long-term Data and Commitment to Treatment: As obesity is a chronic condition requiring long-term management, VK2735 will need to demonstrate long-term safety and efficacy to gain trust from both prescribers and patients.

In summary, VK2735 has a potentially favorable market outlook based on early efficacy and safety data. Its market potential will depend on how it compares to existing treatments in longer-term studies, its safety profile, cost, insurance coverage, and the ability to meet the ongoing and significant need for effective obesity treatments.